There is no monopolisation in the Dutch plant breeding industry. This is shown by the study "Competition in seeds", commissioned by the Dutch Lower House. It was decided in 2011 to investigate the measure, types and possible social consequences of continued monopolisation in the Dutch plant breeding industry.

The general conclusion that can be drawn from the study is that there is no monopolisation in the Dutch plant breeding industry, Sharon Dijksma writes in a letter to the Lower House. Based on the sub studies of the three crops, the potato crop shows a high level of concentration. The main contributors to the high level of concentration are scale and synergy advantages, mergers, and takeovers. By achieving an optimal scale size, potato breeders can gain efficiency. Growers of seedlings have ample freedom of choice and are easily able to switch suppliers.

For both the tomato and pepper crops, there is a concentrated market. Mergers and takeovers contribute to the concentration, same as with the potato crop, and there is also ample freedom of choice and it is easy to switch suppliers. Concentration doesn't lead to higher prices or less innovation. The research also shows that concentration in the plant breeding industry has two causes, namely:

a. economical: the most important are scale and synergy advantages to the innovation process, mergers and takeovers, and globalisation.

b. institutional: protection of intellectual property, reflected in the processing time and cost of patent applications and licenses to develop and market GMO's.

With the emergence of biotechnology in plant breeding and the introduction of genetic modification, the interest in using patents as a system for IP protection grew. Patent laws in Europe allow patents for plant characteristics since 1998, the year of the adoption of the EU Biotechnology directive (directive 98/44EG of July 6th, 1998). Concentration is partially achieved by mergers and takeovers, especially in the wake of the introduction of the Seeds and Planting Act in 1967.

Potato Crop

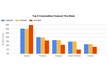

The report shows that the causes for the concentration of the potato crop lie in the increasing share of R&D costs in relation to turnover (see figure 6, p. 15), the increased capital intensity, and because of mergers and takeovers. It turns out that customers usually buy from multiple seedling trading companies, that there is ample freedom of choice, and that it is easy to switch suppliers. This puts a brake on the market power of breeders. Furthermore there are no indications that seedling trading companies stipulate for exclusive supply, thus creating a position of dependency for the customers.

Potato breeders apply both the Seeds and Planting Act of 2005 and the Community plant variety rights to protect their new varieties. This shows that breeders work closely together on fundamental research.

Tomato and Pepper Crop

Researchers report that the market for tomato and pepper seeds can be considered the most mature and most advanced of all vegetable seeds. This means that the total market size is stable and breeding can usually be characterised as high tech. It is also a worldwide market, with several big multinationals from the US, France, Japan, Switzerland, and Germany, besides three leading Dutch companies - Rijk Zwaan, Enza Seeds and Bejo Seeds.

The world market traditionally has a strong geographical cluster of breeders. Several business models and competitive strategies coexist in this market. Some breeders are strongly geared towards the development of 'the best product' (product leadership), while others conduct a 'me too' strategy (cost leadership). Every vegetable crop generally has its own market leader, and the individual tomato and pepper crops are no different. On top of that, the market leadership for the Tomato and Pepper crops isn't 'robust': the growers association has a strong preference for the tomato or pepper variety with the highest yield; the bulk of the market will therefore switch whenever a better variety presents itself.

The conclusion is that the market for tomato and pepper seeds is a concentrated market. Acquiring market position through mergers and acquisitions, scale and synergy advantages in R&D and overhead costs, and a lack of successors within small family businesses are named as reasons for concentration. The concentrated market offers the growers of tomatoes and peppers a freedom of choice, as breeders select varieties with the best characteristics and highest yields.

There are no indications that breeders stipulate for exclusive supply of vegetable seeds, thus creating a position of dependency for the customers, same as with potato seedlings. Innovations are aimed at improvements such as protection from diseases and insect infestations. Breeders are well aware of the growing processes and the needs of the customer, and therefore continually innovating. The race to be the first to come up with a better variety is intense, and innovation doesn't seem to be slowing down. Breeders apply both plant variety rights and patent rights to protect the innovations of tomato and pepper crops, depending on whether it's for protecting plant varieties or an innovation. Both larger and smaller breeders participate in contract research, the same as with the potato crop.

Social consequences

As stated above, there is concentration in the plant breeding industry. This can have social consequences on the position of growers, the pace of innovation, food quality, and food assurance. Concentration can influence the price of starting materials for growers, and they will immediately notice this in their purchasing costs. This is offset by additional revenue thanks to increased yields through innovation. Breeders gain scale size through concentration, which in turn leads to gains in efficiency. The price of starting materials may drop because of this. Breeders can obtain a larger market share this way. It should always be taken into consideration that growers will choose the variety with the best characteristics. It usually doesn't pay off to select a cheaper variety, as the breeding industry is characterised by a 'winner takes all' innovation race. As long as growers have their choice of breeders, it's expected that concentration will have no negative effects on food quality and assurance. It's hard for a single breeder to supply the whole market, and market leadership rarely seems indefinite.

Current developments intellectual property

In the report, researchers highlight the discussion in the Lower House to correct the balance between protection of and access to biological material. Redressing the balance between plant variety rights and patent rights is possible, based on solutions put forward in the report of mister Trojan, the proposed amendment to Article 53b of the 1995 National Patent Law in conjunction with the introduction of a limited breeding exemption, and the introduction of a code of conduct for licensing.