The height, the widespread nature, and the continued acceleration of inflation dominated the headlines in May. “According to the May edition of the IRI monthly survey of primary shoppers, consumers are extremely aware, and many are applying lessons learned during the Great Recession to tighten spending,” said Jonna Parker, team lead of the Fresh Foods practice at IRI.

- Awareness of inflation has been extremely high since the early fall of 2021. The difference between then and now is the level of consumer concern about inflation and the subsequent reactions when buying groceries, which are intensifying by the month.

- The widespread nature and height of inflation are pressuring spending for many consumers, including 38 percent who described their financial health as strained. Thirty percent of American households stated they struggle to afford needed groceries.

- At the same time that 45 percent of consumers looked for sales specials, 55 percent said that fewer of the items they want are on sale, and 42 percent felt that items were not discounted as much, according to the May survey.

- Despite the high gas prices, 16 percent of consumers visited more stores in May than they normally do to capitalize on sales promotions or everyday low prices.

- The share of home-prepared meals continued to average around 80 percent. Consumers would like to eat out more but recognize that home-cooked meals are cheaper.

“Compared with the fall of 2021, inflation is higher, more people are making changes, and the supply chain challenges from labels to packaging to transportation and labor continue to be significant,” said Joe Watson, VP, retail, food service & wholesale for IFPA.

“Compared with the fall of 2021, inflation is higher, more people are making changes, and the supply chain challenges from labels to packaging to transportation and labor continue to be significant,” said Joe Watson, VP, retail, food service & wholesale for IFPA.

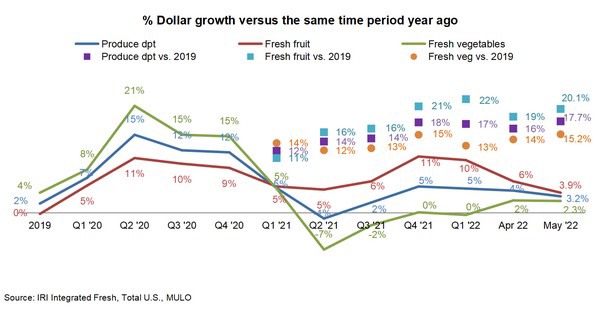

May 2022, fresh produce sales reached $7.5 billion, surpassing the record set in 2021 by +3.2 percent. However, looking beyond dollars that were highly affected by inflation, unit and volume declined.

May was the second time vegetable sales were decidedly above year-ago levels since the second quarter of 2021. Vegetable dollars increased +2.3 percent. At the same time, year-on-year fruit gains have been slowing since the fourth quarter of 2021 to +3.9 percent in May 2022. “In May 2022, berries sales continued to be more than double that of the number two seller, melons,” said Parker. “Pineapples dropped out of the top 10, and cherries made their inroads. Volume sales were a mix with increases for berries and grapes but down results for all other top 10 sellers.”

“In May 2022, berries sales continued to be more than double that of the number two seller, melons,” said Parker. “Pineapples dropped out of the top 10, and cherries made their inroads. Volume sales were a mix with increases for berries and grapes but down results for all other top 10 sellers.”

“Eight out of the top 10 vegetable sellers grew sales versus a year ago,” said Watson. “Pound sales were down for most fresh vegetables, with cucumbers being the lone exception in the top 10 sellers.”

The next report, covering June, will be released in mid-July.

Please click here to see the full report.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

[email protected]

www.210analytics.com