European physical markets

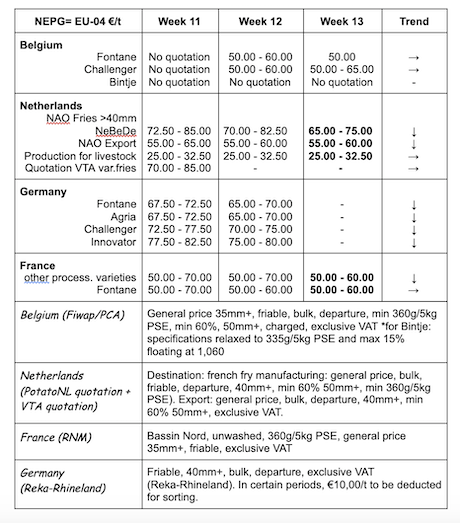

Price summary €/t (source: NEPG):

Belgium

Fiwap/PCA market message:

Potatoes for processing: markets are still calm: few active buyers and not so concrete offer (partly due to the resumption of activity in the fields). Export remains very difficult because of logistic problems and high transport costs.

Fontane: mostly 5.00 €/q, calm;

Challenger: 5.00 - 6.50 €/q, calm;

Bintje: no quotation due to lack of transactions. Very heterogeneous Bintje quality so transactions are rare, between 5.00 and 11.00 €/q.

Fresh market: somewhat differing reports regarding supermarket sales but in general, the activity remains good and higher than before the crisis. The global offer seems limited to firm flesh varieties (low stocks), and larger for soft flesh varieties. Prices are stable or high for the most demanding quality categories. The first early potatoes imported are now available on the shelves.

Fresh market: somewhat differing reports regarding supermarket sales but in general, the activity remains good and higher than before the crisis. The global offer seems limited to firm flesh varieties (low stocks), and larger for soft flesh varieties. Prices are stable or high for the most demanding quality categories. The first early potatoes imported are now available on the shelves.

Firm flesh: the top quality remains difficult to find due to the low initial yields and various defects reported (high PSE, wilted tubers, blue spots…). The average quality is between 20.00 and 25.00 €/q, and the (rare) top quality is traded at higher prices (up to 30.00 €/q);

Soft and mealy flesh: the supply of washable quality is not excessive and prices are stable from 10.00 at the producer and up to 15.00 €/q for example if washable and good for cooking.

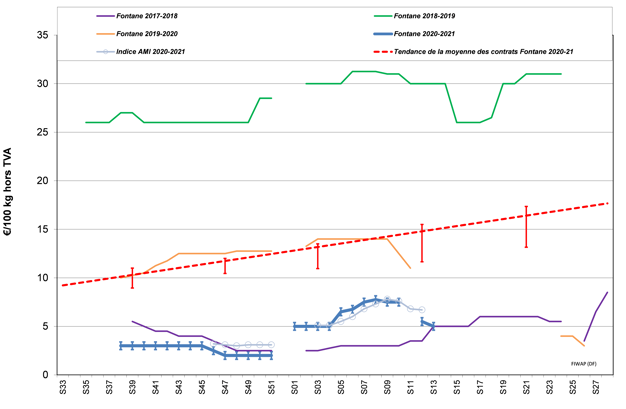

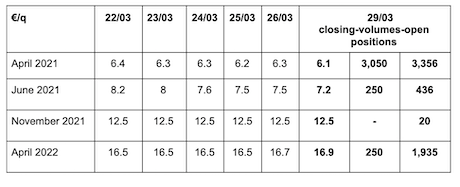

Forward market

EEX in Leipzig (€/q) Bintje, Agria and related var. for transformer, 40 mm+, min 60 % 50 mm +:

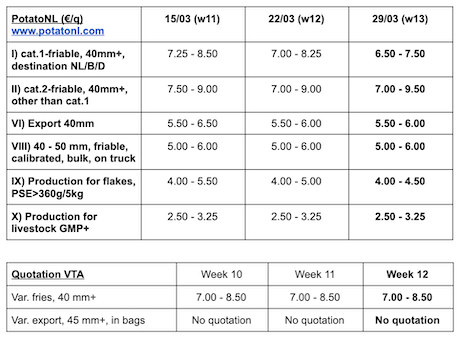

Netherlands

The various businesses with processed products are still restrained by the lockdowns and extended closure of restaurants and the event sector. Dutch factories are producing cautiously and not taking any volumes other than contracts during this still very uncertain period. Quotations for the industry are slightly down. On the domestic fresh markets, retail sales are still 10% higher than before the crisis.

France

The decrease in prices is being felt on all processing markets and few factories are buying but there is some intermediate trade (French and also German). Overall, contracts are removed without delay. The export market is still abnormally calm, with prices that are stable or slightly down. Presence of buyers from eastern countries again in some regions but the price context remains difficult.

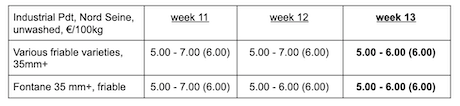

Industrial production, bulk, departure, excl.VAT, Nord-Seine, €/qt, min - max (moy)(RNM):

Germany

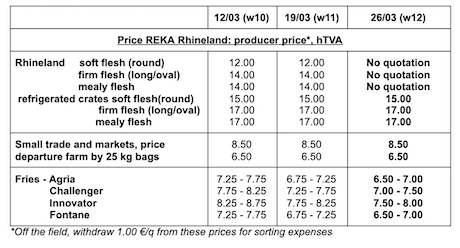

Fresh market (early and semi-early): unchanged prices for firm flesh at 10.83 €/q (same before last quotation), and also unchanged for soft/mealy flesh at 10.25 €/q (same before last quotation). But the merchandise from refrigerated crates-pallets is 3€ higher (see REKA prices in table below!).

In February, the potato consumption was 2.5% higher than in February 2020. Because of increasingly higher numbers of tares and additional preservation costs (new antigerminatives, cold units), the financial difficulties on some farms are getting more and more complicated. And the lockdown again for Easter is not helping the situation...

Processing market is slightly down: 7.50 - 8.00 €/q for Innovator (8.25 - 8.75 € last week) as well as for Agria at 6.50 - 7.00 €/q (7.25 - 7.75 €/q), Challenger 7.00 - 7.50 €/q (7.75 - 8.25 €) and Fontane at 6.50 - 7.00 €/q (7.25 - 7.75 €/q). Varieties for chips/crisps are stable but firm: 9.00 to 13.00 €/q.

Planting of early natives: in the early regions (Palatinate, Baden-Württemberg, Rhineland, Burgdorf region (Lower Saxony), the planting under tarp is completed and the planting without protection is well underway.

Organic potatoes: unchanged producer prices at 40.00 €/q (all varieties and markets combined), returned trade.

Great Britain

Average price free markets for the week ending on March 20th, 2021: 147.02 £/t (+/- 162 €/t), which is a 4.02 £/t decrease (-2.7%).

For more information:

FIWAP

www.fiwap.be