Sea-Intelligence has published issue 159 of the Global Liner Performance (GLP) report, with schedule reliability figures up to and including October 2024. As the report itself is quite comprehensive and covers schedule reliability across 34 different trade lanes and 60+ carriers, this press release will only cover the global highlights from the full report.

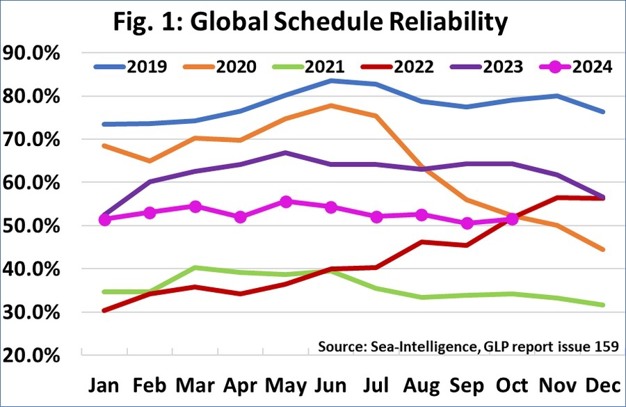

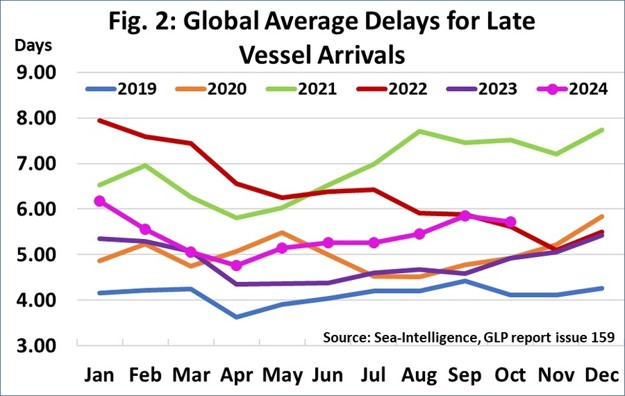

In October 2024, global schedule reliability improved by 0.9 percentage points M/M to 51.5%. So far in 2024, schedule reliability has largely stayed within the 50%-55% range. That said, despite being disappointingly low, the low levels of volatility in schedule reliability in 2024 do give shippers a relatively good idea of what to expect M/M. The average delay for LATE vessel arrivals decreased by -0.14 days M/M to 5.72 days. This is the second-highest figure for the month, only surpassed by the pandemic high of 2021.

Maersk was the most reliable top-13 carrier in October 2024 with schedule reliability of 57.9%, followed by MSC with 52.0%. 10 of the remaining 11 carriers were within the 40%-50% range, while PIL was the least reliable carrier at 37.2%. 8 of the top 13 carriers recorded an M/M improvement in schedule reliability in October 2024. Wan Hai recorded the largest increase of 5.4 percentage points, and ZIM recorded the largest decline of -3.5 percentage points. On a Y/Y level, none of these carriers recorded an increase, with 12 of the top 13 carriers recording double-digit Y/Y declines.

For more information:

Sea-Intelligence

Email: [email protected]

www.sea-intelligence.com