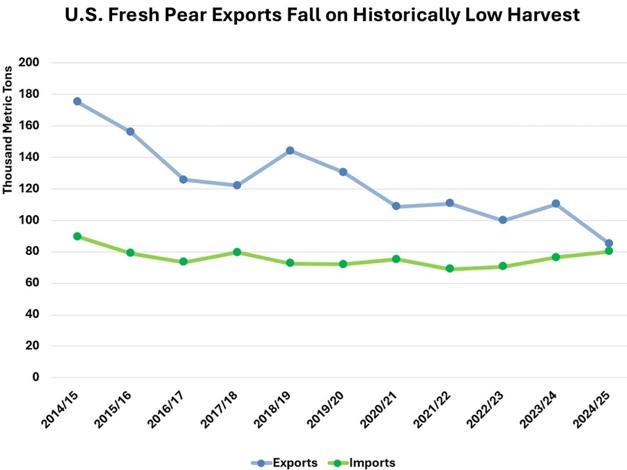

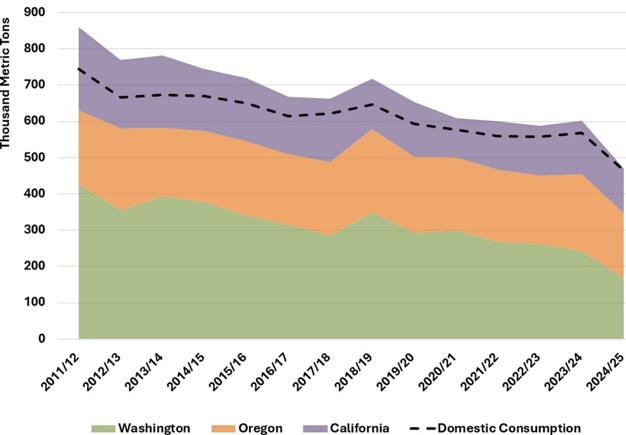

U.S. fresh pear exports are forecast to fall to the lowest level since the 1980s in marketing year 2024/25 (July 2024 – June 2025) as production is expected to fall more than 20 percent. U.S. pear production is forecast at 470,000 metric tons (tons) the lowest volume since 1967/68, as all three producing states experienced year-over-year declines. The United States is expected to fall to the world's sixth-largest pear producer in 2024/25 after being ranked fourth the previous year and third for most of the preceding decade. Constrained by this historically low harvest, U.S. fresh pear exports are forecast at 85,000 tons, less than half the volume exported a decade ago, and at nearly the same level as fresh pear imports.

Output in Washington, normally the top pear-producing state, is projected to drop more than 30 percent and be a smaller harvest than Oregon. A freeze in January damaged pear trees and continued cold weather during the spring blossom further limited volumes. This adverse weather compounds a decade-long trend of falling acreage in Washington. Oregon production is forecast down 15 percent and California down 17%, also due to damaging weather.

Due to the lack of exportable supplies, U.S. fresh pear exports are forecast down 25,000 tons to 85,000, the lowest level since 1988/89. In the first 3 months of the marketing year, exports fell by more than 40 percent compared to the same period in 2023/24. Typically, 90 percent of U.S. pear exports are destined for Canada and Mexico as pears are delicate and difficult to transport long distances. The United States is the top exporter to these markets with approximately 90 percent market share in Mexico and 50 percent in Canada. While the United States may lose some market share in 2024/25, it is unclear if other suppliers will be able to fill the gap.

U.S. imports are projected to rise only slightly to 80,000 tons despite domestic supplies dropping sharply as other countries are not forecast to significantly increase exports. While high U.S. prices could attract Southern Hemisphere supplies that are normally directed to other markets (including the European Union and Russia), U.S. import volumes have shown considerable stability in the past decade despite similar supply shocks. While China is forecast to have increased exportable supplies, shipments to the United States are unlikely to significantly increase because supplies are dominated by Asian varieties of pears that are not readily substituted for U.S. pear varieties that saw the biggest drop in production such as Bosc and Green Anjou. Last year, nearly 30 percent of domestic supplies were allocated to processing. Due to high fresh market prices and significant canned pear inventory, more pears will be sold on the fresh market this year and imports will not be increased to supply processing.

To view the full report, click here.

For more information:

For more information:

USDA

Tel: +1 (202) 720-2791

Email: [email protected]

www.usda.gov