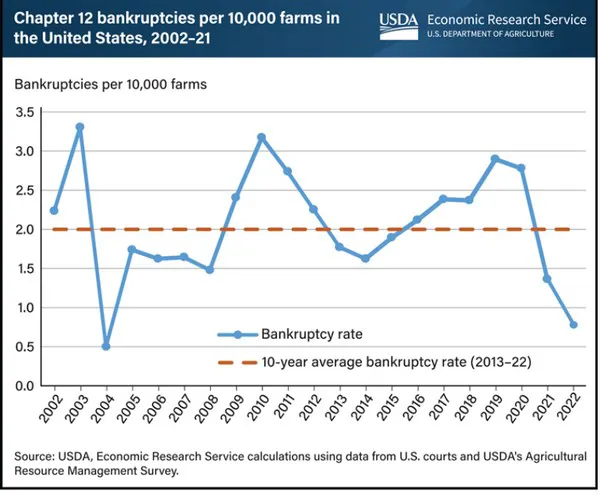

In 2022, the Chapter 12 bankruptcy rate reached the lowest level in nearly two decades, 0.78 bankruptcies per 10,000 farms. Under Chapter 12 bankruptcy, a financially distressed family farmer can propose and carry out a plan to repay their debts fully or partially, and the total number of these bankruptcies is an indicator of financial stress in the farm sector. In 2003, the annual bankruptcy rate reached a high of 3.3 per 10,000 farms and then declined to a low of 0.5 per 10,000 farms in 2004.

After 2010, the bankruptcy rate declined until 2014 but started to increase again in 2015 with another peak in 2019 (2.9 bankruptcies per 10,000 farms). Since then, bankruptcies have declined to the lowest level in two decades after 2004. In 2022, 0.78 farms per 10,000 filed for Chapter 12 bankruptcy, almost two-thirds lower (61.0 percent) than the 10-year annual average of 2.00 bankruptcies per 10,000 farms.

Based on the data from U.S. courts, the number of bankruptcies not only declined nationally, but also in the major agricultural States. When examining the 10-year average bankruptcy rate (2013–22) for major agricultural States, Wisconsin had the highest rate at 5.66 per 10,000 farms, followed by Nebraska and Kansas. Texas had the lowest average bankruptcy rate among the top 10 agricultural States at 0.77 per 10,000 farms. This chart uses data from U.S. courts and the USDA’s Agricultural Resource Management Survey (ARMS) to update information in Agricultural Income and Finance Situation and Outlook: 2021 Edition and the Amber Waves article, Chapter 12 Bankruptcy Rates Have Increased in Most Agricultural States, published in November 2021.

Source: ers.usda.gov