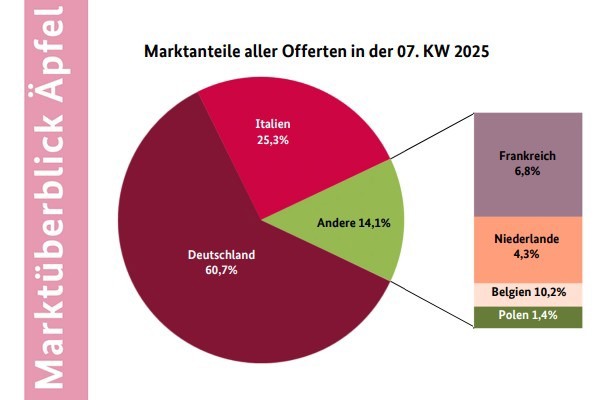

Domestic varieties continued to form the basis of the apple supply. Mostly loose, but also presented in crates, Elstar, Boskoop, Tenroy, and Braeburn usually generated sufficient attention. According to the BLE, the availability of domestic loads had decreased slightly overall. The main varieties coming from Italy were Pink Lady, Granny Smith, and Golden Delicious. France mainly sent club varieties, always presented in layers, like Jazz, Honeycrunch, and Pink Lady. Supplies from the Netherlands, Belgium, and Poland were of a supplementary nature.

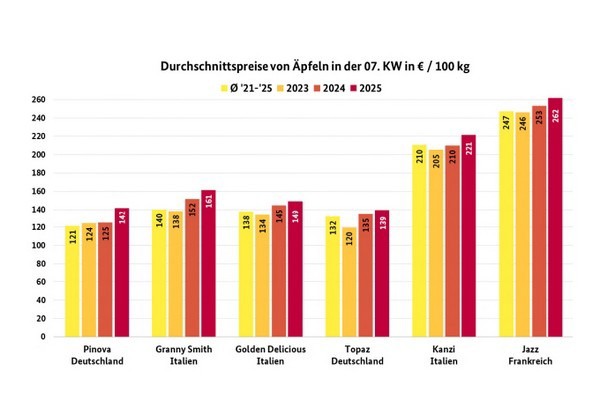

The quality of the European loads was generally convincing. Although the supply decreased slightly, demand was consistently met. Market interest was quite friendly. Traders rarely had to lower their asking prices. In some places, prices were occasionally reduced during the week, when the market was weak, especially in the case of German apples. However, prices also increased in some cases.

Click here to go directly to the full market and price report

Domestic apple harvest in 2024 down 12.4% on the ten-year average

Apples continue to be by far the most abundant fruit harvested in Germany. In 2024, fruit-growing businesses recorded a well below-average apple harvest of 872,000 tons. As reported by the Federal Statistical Office, in 2024 about 122,900 tons or 12.4% fewer apples were harvested than on average over the past ten years. The main reason for the poor apple harvest was unfavorable weather conditions, which caused significant crop failures of up to 90% compared to the ten-year average, especially in the eastern federal states. The harvest in North Rhine-Westphalia, which was initially forecast just as poorly, ultimately turned out somewhat better.

Since apple trees usually do not begin to bloom until the end of April in this region, and since we are getting warmer spring days earlier and earlier in Germany, flowering often begins weeks earlier. As a result, late frosts are affecting apple tree blossoms more and more frequently. Last April, late frosts and hailstorms caused frost damage and poor fruit set in many orchards. As the growing season progressed, cool, damp weather and heavy rainfall in some regions had a negative impact on fruit development and increased the risk of diseases. According to the final figures, however, the effects were less than predicted in the preliminary harvest estimates. When the first harvest estimate was made in July 2024, it was expected that the apple harvest would be as much as 26.3% or 261,300 tons lower than the ten-year average.

There were sometimes major regional differences. While the number of apples harvested in almost all federal states was well below the level of previous years, fruit-growing businesses in Baden-Württemberg, the most important federal state for domestic apple growing, achieved a comparatively good apple harvest. At 395,400 tons, it was about 19.4% above the ten-year average and thus accounted for about 45.3% of the apples harvested nationwide. About three-quarters (73.2% or 638,900 tons) of the apples harvested in 2024 were intended for marketing as a dessert fruit. In the EU, Germany, Austria, the Czech Republic, Poland, Hungary, Romania, and Belgium were affected by significant crop failures in 2024. Overall, this led to a low EU harvest and, as a result, to further price increases.

Pears

The assortment continued to be dominated by the Italian varieties Abate Fetel and Santa Maria. Most of the Santa Maria came from Turkey, along with a small quantity of Deveci. The Netherlands mainly supplied Xenia and Conference. Imports from overseas increased in relevance.

Table grapes

South African offers dominated, followed by loads from Peru and Namibia. The range was consistently very wide. Demand could hardly keep pace with availability. Although the quality of the items was still convincing, traders often had to accept discounts.

Oranges

The season was slowly coming to an end: both availability and interest were declining. The late varieties took over the market for oranges. The low temperatures boosted demand: the storage options had definitely improved.

Small citrus fruits

The presence of mandarins visibly melted away. The low temperatures had certainly sparked renewed interest, but in some places, there was no denying a certain customer saturation. Spanish Nadorcott and Tango dominated the scene, followed by Israeli Orri, which were mostly convincing in terms of organoleptic properties.

Lemons

Spanish Primofioro lemons predominated and were available in some places in a monopoly-like fashion. Unloadings from Italy, Egypt, Greece, and Turkey supplemented the range. The wintry weather had improved the accommodation options.

Bananas

The supply was sufficient to meet continuous demand. The wintry weather had limited the accommodation options in some places. Prices developed unevenly: in Frankfurt, they trended upwards for the entire range.

Cauliflower

Italian offers predominated, followed by Spanish offers at a considerable distance. In addition, France, the Netherlands, and Belgium were involved in small quantities. The availability increased; the demand could not always keep pace. Therefore, the quotations often trended downwards, in some cases quite sharply.

Lettuce

For iceberg lettuce, only Spanish loads were available. Nevertheless, a fairly wide price range was established due to inconsistent quality. For head lettuce, there were primarily Belgian and Italian loads, with French produce supplementing the supply.

Cucumbers

Spanish loads were predominant, but overall, they lost market share as their presence diminished. Occasionally, there was a gap in supply, which led to rising prices. Deliveries from the Netherlands increased a little but still did not always manage to fully satisfy demand.

Tomatoes

A wide and varied range was available. Overall availability had increased. In general, demand was not always able to keep pace with the increased supply. As a result, traders were often forced to offer prices successively lower.

Sweet peppers

Spanish loads dominated, flanked by Turkish and Moroccan imports. Deliveries were limited. This had an impact on prices, which rose sharply in some cases. Up to €20 per 5-kg box was to be paid in Frankfurt and Berlin. In particular, yellow offers became pricier.

Source: BLE