The first half of 2021 is on the books and 210 Analytics, IRI and the Produce Marketing Association (PMA) partnered to understand how fresh produce performed relative to 2020 and 2019.

The first half of 2021 brings a 1.2 percent increase over year ago sales levels for fresh produce sales, despite a small decline in the second quarter. Produce added an additional $438 million in sales during the first six months of 2021.

Volume (pound) sales however were not able to hold the line and dropped 4.8 percent versus 2020 levels during the first six months of the year.

Food inflation

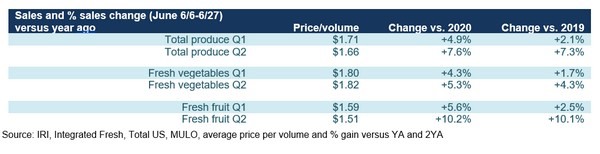

Food inflation has become a big topic of discussion in recent weeks and, this year, produce prices are not the exception like we saw in 2020. Food prices in both the retail and restaurant settings are seeing significant inflation. In June, food prices overall were up 2.2 percent year over year, according to the Bureau of Labor Statistics (BLS).

Consumers are well aware of the inflationary conditions, said Jonna Parker, team lead, fresh for IRI. “According to the June IRI survey of primary shoppers, a total of 84 percent being somewhat (56 percent) or very (28 percent) concerned about food cost inflation,” she said. “Stores’ promotional decisions, merchandising and price perceptions are likely to grow more important as a result.”

When comparing the six months’ dollar sales to that of 2020, growth engines emerge. “While being the sales growth leader all throughout 2020, berries again took the top honors with an additional $376 million in sales the first half of 2021 compared with year ago,” said Joe Watson, VP of membership and engagement for the Produce Marketing Association (PMA). “The story for salad kits is equally remarkable as a top grower in 2020 and yet adding another nearly $200 million in sales the first half of this year.”

Shelf-stable fruit also gained versus year ago, at +0.7 percent. Frozen fruits and vegetables remained up about 15 percent over 2019 but could not match their 2020 performance.

June brought continued normalization of grocery shopping patterns, according to Parker. “The share of the consumers who are ‘extremely’ concerned about the COVID-19 pandemic dropped to 22 percent of the population. That is the lowest level since IRI started to track consumer concern among primary grocery shoppers as of mid-March 2020.”

Consumers are re-engaging more and more with restaurants. As of June, 81 percent of Americans have purchased restaurant food, often a combination of in-restaurant dining (46 percent), outdoor restaurant dining (17 percent), takeout (50 percent) or delivery 20 percent).

The next report covering July, will be released in mid-August. Contact Joe Watson, PMA’s vice-president of membership and engagement at jwatson@pma.com with questions or concerns.

For the full June report, click here.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

aroerink@210analytics.com

www.210analytics.com