"The pricing isn't good enough; there's more money to be made from Conference pears," says Dirk Couke. He is the CEO of DLV consultants and the Fruit Trading Company (FTC). He and the Fruit Growers Action Group organized a webinar. It was called 'Pricing the Conference: predictable and fair?'

Dirk says this was one of the main outcomes of a survey done before the webinar. He indicates that is what growers, as well as traders, think. Most of the webinar's Dutch and Belgian participants - 70 - are fruit growers. There were 65 who were affiliated with a cooperative or growers association. Other participants included fruit traders, suppliers, buyers, and consultants. The webinar was held on November 26.

The survey revealed that most of the participants believe they should join forces. But cooperatives should do more. "They said there is too little movement and innovation. There should also be more online sales," explains Dirk. And people also doubt the workings of an auction. "It's not the principle that's wrong. But the way it's handled. "

Suggestions for improvement included different packaging and more creative sales. It also became apparent that growers would like to choose their own sales time. More contract prices, if they are above cost prices, are preferred too. Plus, more transparency is needed.

Online sales platform

The current top fruit chain consists of auctions, free growers, brokers, and traders. Dirk says this chain lacks a grower-supported online sales platform. "One that, at least, generates a bidding process and a transparent price. That is for all buyers - both from auctions and free growers. It's clear that bidding leads to mostly better prices."

He is certain an online sales platform will be successful. It must, however, be grouped. And as much fruit as possible must sell via the platform. But in a way that it is not all at once. "It has to be organized. And it must be, at least, partly owned by growers, be they from cooperatives of free growers. If they own the platform, it will work better and be used more than at present. I'm firmly convinced of that."

Predictable

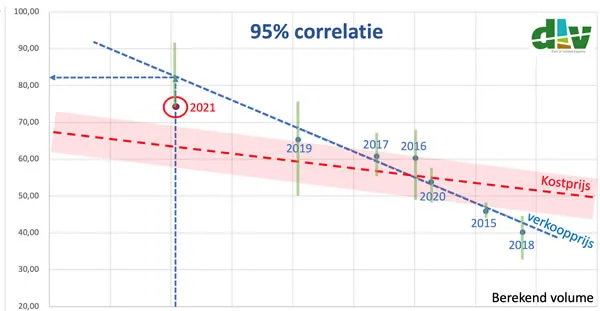

"Can you predict the price of Conference pears? I'd say so; there is a 95% correlation between price and calculated supply." Couke points out that if you know what the harvest volumes are, you can predict prices. "The higher the initial stock relative to the normal stock, the lower the price. The lower the initial stock, the higher the price." He has done calculations over several quarters between 2016 and 2020.

He arrived at an average price increase of more than €0.01 when supplies decreased by one percent. "There's a 95% correlation (relative to the Prognos volumes) between supply, calculated volume, and price. For 2021, that means normal prices with an expected middle price of €0.82/kg. That is always based on the same imaginary pallet of graded Conference pears at auction."

The correlation between Conference pears' calculated volume and their price

Dirk has also noticed that even with this year's lower volumes, costs prices are rising. That is because the hectare costs have remained relatively unchanged. "The more pears the trees bear, the lower the cost per kilogram," he says.

His calculations show that when the pears/hectare increase by 20 tons, people should take a €0.10/kg decrease in cost price into account. "Delivering less volume is very clearly more profitable. As volumes fall, the cost price line climbs less than the yield line."

Limiting supplies?

The World Apple and Pear Association (WAPA) announces its top fruit estimates at Prognosfruit. As soon as that happens, Conference pear prices are more or less fixed, says Dirk. He wonders if that is fair. "A two-thirds majority of the webinar participants say no. We could be making more from those pears."

He sees opportunities for this in the price/calculated volume correlation. Dirk points out that this shows when the whole sector has fewer Conference pears, prices rise far more strongly than the cost price. "So you benefit from supplying less volume."

Based on that, limiting supplies is a great suggestion, he thinks. "Should production become limited in the Benelux, that is much of Europe's volume." That could take the form of a delivery quota, for example. "It won't be easy to achieve with so many growers, but it's worth considering."

Contract prices guided by cost prices are another way to reach fairer pricing. Here, the CEO sees opportunities to agree on contract prices for Prognosfruit. These can then be adjusted using WAPA's supply estimation. "I think this is a great way to set contract prices early in the season."

In short, Dirk sees several opportunities to improve Conference pricing. At the end of the webinar, he said he hoped the industry would take advantage of those opportunities. Then better, more consistent pricing can be achieved.

For more information:

Dirk Coucke

DLV / Fruit Trading Company

201 Koolmijnlaan

3582, Beringen, Belgium

Tel: +32 (0) 495 292 500

Email: [email protected]

Website: www.fruittradingcompany.be