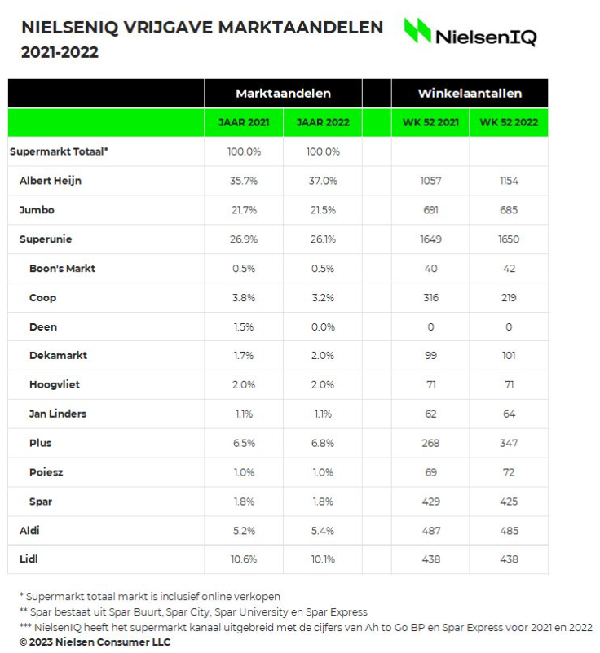

IRI and Nielsen have released Dutch supermarkets' final revenues and market shares for 2022. Both research firms found that the trend in online sales' reversed. After years of climbing, that share decreased last year. Albert Heijn's (AH) market share rose partly because it acquired some stores from another Dutch chain, Deen.

According to IRI, hard discounters gained significant market share. Nielsen shows that Aldi gained 0.2% market share, but Lidl lost 0.5%. According to Nielsen, total supermarket sales divided among these stores rose by three percent to 46.3 billion.

IRI

IRI considers 2022 a year of falling volumes compared to the 2021 pandemic year when the hospitality sector closure benefited supermarkets. Sales-wise, however, 2022 was another record year: sharply rising prices meant total sales increased by 3.9% in 2022 to nearly €46.9 billion. AH gained the most share through its acquisition of the Deen stores, but discounters Aldi and Lidl also both gained significantly, restoring their market share to pre-pandemic levels.

Table 1: Market share for all supermarkets (incl. Hard Discount and Online).

Table 1: Market share for all supermarkets (incl. Hard Discount and Online).

Festive season sales keep growing, online's growth weakens

The 2022 festive season contributed to the overall annual growth. In the previous year, there were still COVID-related restrictions over the holidays, resulting in record supermarket sales. Last year's holiday revenue was even higher (+5.9%). That was partly due to much higher prices.

Online sales, however, contributed very little to 2022's total growth: 3.2% of that growth comes from online, whereas in 2021, that made up almost 60% of the total growth. Still, supermarkets' online channels increased slightly by +2.4%.

Albert Heijn, hard discounters gain most market share

The market shares published by IRI are calculated to include hard discounters and 'traditional' supermarkets' online sales. Market leader AH increased its market share the most in 2022. Its market share rose by one percentage point. Aside from taking over the Deen stores, the considerable expansion of AH to Go stores at gas stations aided that growth.

For the first time in a long time, Jumbo's market share fell in 2022 by 0.4% to 21.2%. PLUS's market share grew due to its acquisition of Coop stores. The market's number four, the new Plus/Coop combination, collectively achieved a 9.9% market share in 2022.

Together, all Superunie members' market share decreased by a percent to 25,6%. That was primarily due to the loss of the Deen stores. But Superunie managed to limit the overall loss. That was thanks to the growth of price-oriented stores like Boni, Nettorama, and Dirk and the strong growth of Dekamarkt and Vomar, which also took over several Deen stores.

Hard Discounters were the biggest losers in the 2020 pandemic year but stabilized in 2021. In 2022, their market share grew again, by 0.5% to 16,2%, which equals the pre-COVID year, 2019. Hard discounters' market share grew mainly in 2022's second half when price became an increasingly important issue for many shoppers.

Notes

- Market shares are calculated within the IRI universe of Total Supermarkets, including independent stores and 'regular' supermarkets' online sales. Sales of purely online players, such as Picnic, are not included.

- The Superunie stores (like Dirk, Vomar, Nettorama, and Boni) not included in the table below did not consent to their market shares being published. Superunie also has a group of other independent stores that purchase through Superunie.

- *Spar excludes Spar express.

Nielsen

The supermarket sector ended 2022 with revenues of €46,3 billion, representing a three percent growth. That growth is valued at €1.35 billion. Last year's rise in turnover is due to price increases caused by various turbulent developments in Europe. Those include increased energy prices and raw materials shortages. Price hikes have become commonplace.

That means, in December 2022, prices (based on >35,000 items) were, on average, 17.3% higher than a year before. These price increases put pressure on many categories' volumes. After the 2021 fall in volume - due to the 2020 pandemic peak - 2022's further volume decline negatively impacted sales. That was fully offset by the price component's positive effect, leading to the three percent growth.

The higher prices meant shoppers more often opted for retailers' house brands. These sales rose to 43.8%, a 1.8pp increase. That is contrary to the recent trend in which the house brand share kept falling.

Another break in the trend relates to online sales' market share increase. In recent years, that share grew yearly, catalyzed by the pandemic. However, in 2022, online sales' share remained the same as in 2021: 5.2%.

This table shows how retailers' market shares developed in 2022:

Click here to enlarge

Hard discounters

Nielsen and IRI's figures are fairly consistent, except for the discounters. IRI does not break down hard discounters into Lidl and Aldi. At Nielsen, Aldi gained a 0.2% market share, and Lidl lost 0.5%. Also, hard discounter totals fell by 0.3%. At IRI, hard discounters (Lidl and Aldi together) gained a 0.5% market share.

Source: IRI, Nielsen