C.H. Robinson Worldwide, Inc. today reported financial results for the quarter ended December 31, 2022.

"We're increasing our focus on delivering a scalable operating model to lower our costs, improve the customer and carrier experience and foster long-term profitable growth through cycles," said Scott Anderson, Interim Chief Executive Officer. "The current point in the cycle is one of shippers managing through elevated inventories amidst slowing economic growth, causing unseasonably soft demand for transportation services. At the same time, prices for ground transportation and global freight forwarding are declining due to the changing balance of supply and demand. While a correction in the freight forwarding market was certainly expected, the speed and magnitude of the correction in only two quarters was unexpected, with ocean rates on some trade lanes already back to pre-pandemic levels."

"I believe we’re uniquely positioned in the marketplace to deliver for our shippers, carriers and shareholders through a combination of our digital solutions, our global suite of services and our network of global logistics experts," Anderson added.

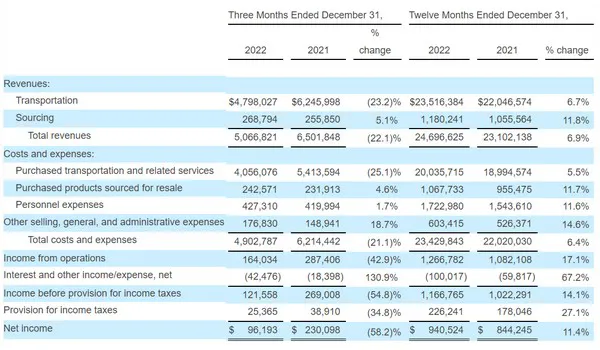

Summary of Fourth Quarter Results Compared to the Fourth Quarter of 2021

- Total revenues decreased 22.1% to $5.1 billion, driven by lower pricing and volume across most of our services.

- Gross profits decreased 10.5% to $761.5 million. Adjusted gross profits decreased 10.3% to $768.2 million, primarily driven by lower adjusted gross profit per transaction in ocean and air.

- Operating expenses increased 6.2% to $604.1 million.

- Personnel expenses increased 1.7% to $427.3 million, primarily due to $21.5 million of restructuring-related costs, which were partially offset by a decrease in equity compensation. Selling, general and administrative ("SG&A") expenses of $176.8 million increased 18.7%, primarily due to $15.2 million of restructuring charges, primarily related to an impairment of internally developed software, and increased legal settlements, partially offset by a decrease in credit losses.

- Income from operations totaled $164.0 million, down 42.9% due to the decrease in adjusted gross profits and $36.7 million of restructuring charges. Adjusted operating margin of 21.4% declined 1,220 basis points.

- Interest and other income/expense, net totaled $42.5 million of expense, consisting primarily of $24.8 million of interest expense, which increased $10.7 million versus last year due primarily to higher short-term average interest rates, and $16.9 million of foreign currency revaluation and realized foreign currency gains and losses, which increased $10.4 million versus last year primarily due to foreign currency revaluation on intercompany assets and liabilities denominated in U.S. Dollars in countries where the U.S. Dollar is not the functional currency.

- The effective tax rate in the quarter was 20.9% compared to 14.5% in the fourth quarter last year. The lower rate in the fourth quarter of last year was due primarily to a favorable mix of foreign earnings and an increased benefit related to U.S. tax credits and incentives.

- Net income totaled $96.2 million, down 58.2% from a year ago. Diluted EPS of $0.80 decreased 54.0%. Adjusted EPS of $1.03 decreased 40.8%.

For more information:

Chuck Ives

C.H. Robinson Worldwide, Inc

Email: [email protected]