As EastFruit has reported multiple times, global demand for hazelnut had been suffering from the consequences of the COVID-19 pandemic and the war in Ukraine. EastFruit analysts highlight that export volumes from Georgia have increased and surprisingly the prices have also moved up. Meanwhile, the Turkish hazelnut suppliers speak of a demand rush.

February trade numbers are just in and they show positive dynamics for Georgia. The country exported 1 430 tonnes of hazelnut kernels, 5% more than in January 2023 and the highest volume in the last 7 years. Moreover, export prices have moved up from $5.00/kg in January to $5.40/kg in February. Increased export volume given the increased prices should mean higher demand.

Did the demand increase significantly? – the answer is no. February’s export price of $5.40 is still the lowest in at least the last ten years. However, of course, a month-over-month increase is welcome.

Georgian stakeholders reveal to EastFruit what exactly is going on behind the data.

Most importantly, they don’t estimate the current demand as strong. They note that large buyers have stocks for the rest of the current season. Right now, all of the action in the Georgian hazelnut market is coming from the distributors who are buying in Georgia and supplying smaller businesses in the EU.

The unresolved economic crisis in Turkey remains a concern. A recent devastating earthquake worsened the situation by far. Turkish Grain Board TMO has lots of hazelnuts in stock, which is viewed as a major risk for prices worldwide. Some market participants in Georgia think that due to the economic crisis, the TMO will have to sell soon. If this happens, it will put large negative pressure on global prices.

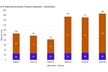

The presence of Azerbaijan is growing. The country’s nuts are also very competitive in terms of prices. Azerbaijani suppliers made an image of hazelnuts from Azerbaijan as a high-quality product. In the 2021/22 season, Azerbaijan increased exports to Germany by 65%, and exports to Italy by more than three times! Now, Azerbaijan supplies more than 11 600 tonnes of hazelnut kernels to these countries and 7 800 tonnes to Russia.

It is interesting to note that Turkish suppliers returning from the Gulf Food 2023 mention an unexpected growth in demand. However, they also note that the buyers are looking for cheaper hazelnuts than Turkey offers. The main reason behind this is that at the current prices, hazelnuts cannot compete with almonds and cashews. Some buyers usually turn to Georgia and Azerbaijan which sell hazelnuts cheaper than Turkey.

For more information: east-fruit.com