The volume of exports of white cabbage from Uzbekistan in January-February 2023 decreased sharply and was the lowest in the same period of the last four years. Such a sharp drop in exports was caused by two main factors – the loss of most of the crop due to January frosts and weak demand in the main foreign markets, EastFruit analysts say.

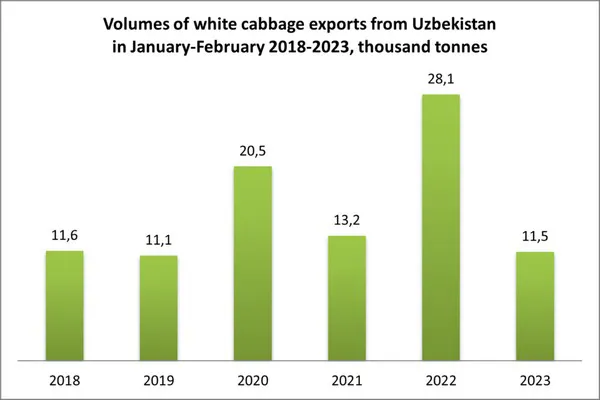

According to preliminary official data, Uzbekistan exported 11 500 tonnes of white cabbage in January-February of this year, which is 2.4 times less than the record figure for the same period in 2022. It is the lowest volume exported in January-February of the last four years.

As can be seen from the diagram, the export in January-February 2023 was at the level of the same period in 2018-2019.

As for the geography of exports, about 99.5% of the total exports were supplied to three countries – Kazakhstan, Russia, and Kyrgyzstan:

- Kazakhstan – 9 500 tonnes (82.7% of total exports);

- Russia – 1 500 tonnes (12.8%);

- Kyrgyzstan – 449 tonnes (3.9%);

- other countries – 63 tonnes.

As noted by EastFruit experts in early February 2023, unlike previous years, this year started with negative developments for Uzbek white cabbage producers. In addition to the huge crop losses due to abnormal January frosts and the absence of available volumes of “chain” quality, there was a low demand for Uzbek cabbage in the main markets.

According to Uzbek exporters, after the January cold weather and its impact on the harvest of white cabbage in Uzbekistan, starting from mid-January, it has become a very difficult task to form batches of “chain” quality cabbage on the domestic market. Given the weak demand for Uzbek cabbage in the main sales markets compared to the same period of previous years, importers’ orders for high-quality cabbage could hardly be fulfilled.

According to market participants, most of the products shipped to foreign markets in the second half of January and in the first ten days of February are of “non-chain” quality, i.e. does not meet the requirements of supermarket chains in the main markets. It was purchased by importers for subsequent sale in food markets since it was difficult to determine the proportion of products damaged by abnormal cold in these batches and the extent of the damage. Accordingly, they are purchased at a lower price. On the other hand, it was an opportunity for Uzbek producers to sell some of their products, albeit at a low price, and thereby minimize their losses.

For more information: east-fruit.com