The Board  of Directors of Orsero S.p.A., on today’s date approved the Draft Separate Financial Statement 2022, the Consolidated Financial Statement and the Sustainability Report (NFS) as at 31 December 2022.

of Directors of Orsero S.p.A., on today’s date approved the Draft Separate Financial Statement 2022, the Consolidated Financial Statement and the Sustainability Report (NFS) as at 31 December 2022.

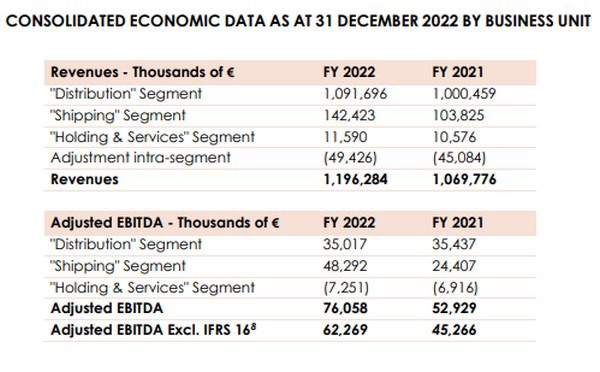

Consolidated economic summary data as of 31 December 2022

Net Revenues, equal to € 1,196.3 million, are up by about 11.8% compared to € 1,069.8 million recorded in FY 2021, with a growth that concerned both the Distribution BU (+9.1%) and, even more significantly, the Shipping BU (+37.2%).

The Adjusted EBITDA, equal to € 76.1 million, up 43.7% compared to € 52.9 million in FY 2021, with an excellent Adjusted EBITDA Margin of 6.36%, up by 141 bps compared to FY 2021.

The Adjusted EBIT, equal to € 45.7 million, grows by 79.0% compared to the € 25.5 million achieved in FY 2021.

The Adjusted Net Profit reports a positive result of € 36.9 million compared to a profit of € 19.1 million recorded in FY 2021, with a significant increase of € 17.9 million (+93.5%) thanks to the higher operating margin, partially offset by the increase in D&A and provisions, of the net financial items (mainly due to higher foreign exchange losses and financial expenses against higher results of companies consolidated at equity) and taxes.

The Net profit stands at € 32.5 million with a considerable increase of € 14.0 million (+75.4% approximately) compared to a profit of € 18.5 million in FY 2021.

Consolidated balance sheet summary data as at 31 Dec 2022

The Total Shareholders' Equity is equal to € 201.5 million, with an increase of about € 25.6 million compared to the Total Shareholders' Equity as at December 31, 2021, equal to € 175.9 million.

The Net Financial Position is equal to € 67.4 million at 31 December 2022 compared to € 84.3 million at 31 December 2021, which include IFRS 16 liabilities equal to € 41.6 million (€ 39.1 million in 2021). The improvement, corresponding to a reduction of approximately € 17.0 million, is the result of the significant cash generation deriving from operating activities for about € 54.9 million, mainly balanced by operating investments of the period for approximately € 14.0 million, higher rights of use IFRS 16 equal to approximately € 15.4 million, the payment of the dividend to Orsero shareholders for a total of about € 5.2 million and the repurchase of treasury shares for approximately € 2.2 million.

Click here to read the full Press Release.

For more information: orserogroup.it