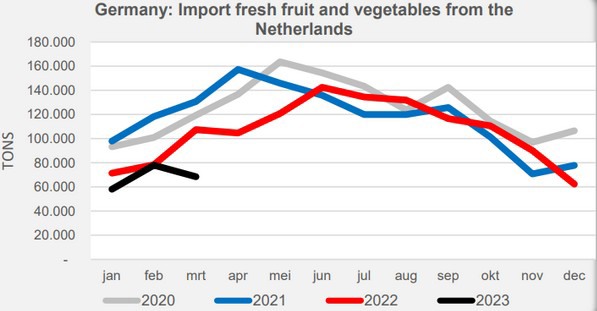

In Germany, Dutch fruit and vegetable imports declined sharply again in 2023's first quarter. It was down 20% compared to last year's first quarter and as much as a third less than Q1 of 2021. In absolute quantities, that amounts to over 50,000 tons less than in last year's first quarter and a minus of 100,000+ tons compared to the same time in 2021.

Germany took fewer of especially the large greenhouse products from the Netherlands. In the first quarter of this year, that country imported a third fewer Dutch tomatoes than in 2022's Q1. And compared to two years back, German imports of Dutch tomatoes halved. Dutch cucumber imports also fell sharply; -30% versus last year and -40% compared to early 2021. Dutch bell peppers still did well on the German market last year, but in the first quarter of this year, that was down a quarter.

The import of open-field carrots grown in the Netherlands also did poorly. The loss in the first quarter compared to 2022 was minimal, but the downward trend of German imports of Dutch carrots continued, as did that of Dutch leeks. A bright spot was that German imports of Dutch top fruit, especially pears, increased.

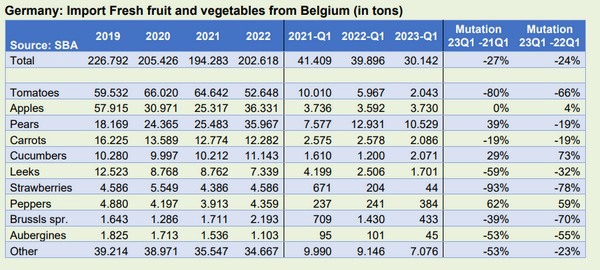

Virtually no Belgian tomatoes imported

According to the SBA, German imports of Belgian tomatoes were virtually zero in 2023's Q1. It barely topped 2,000 tons, while in the same period of 2022, it was 6,000 tons. Belgian pears did less well in Q1 after a good Q1 in 2022. In the first quarter of this year, overall German imports of Belgian produce were a quarter smaller than in the same period of the previous two years.

Total German fruit and vegetable imports fell by 10% in Q1

As a whole, in 2022, total German fruit and vegetable imports decreased significantly. That includes large products such as tomatoes and cucumbers. And in 2023's first quarter, total German imports of fresh fruits and vegetables shrank a further ten percent.

But fruit and vegetables are not the exception. Volume-wise, all German goods imports are shrinking. In this year's first quarter, Germany imported ten percent lower volumes of goods in total. Seen this way, fresh fruit and vegetable import developments, in volume terms, is not unusual.

The Netherlands shows a somewhat different picture, not regarding total goods imports but that of fresh fruit and vegetables. Total German goods imports from the Netherlands shrank by ten percent in Q1, but that of fresh fruit and vegetables by 20%.

Higher prices across the board

In value terms, however, the picture looks different, though. Total German goods imports in Q1 of this year were slightly higher than last year, as were total imports from the Netherlands. In value terms, total German fresh fruits and vegetables imports remained level. The same cannot be said for Dutch fruit and vegetable imports. Their value declined by 14% in Q1.

All that means German import median prices rose considerably; for all goods in Q1, even by 15%, with imports from the Netherlands no exception. Overall, the import price of fresh fruit and vegetables was 13% higher in Q1. Dutch products were, on average, eight percent pricier during that time.

March

In 2023's Q1, German fruit and vegetable imports were down almost across the board. Even of bananas, of which four percent fewer were imported. That minus was 13% for tomatoes and ten percent for cucumbers. Q1 total imports of apples (-14%), oranges -10%), watermelon (-6%), and bell peppers (-15%) were down too. Exceptions were grapes (+7%), pears (+1%), pineapples (+8%), kiwis (+10%), and mangoes (+28%).

Germany's Spanish product imports also shrank considerably - 17% - in the first quarter of this year. Countries from which Germany imported more in Q1 include South Africa (+11%), Morocco (+15%), and Greece (+56%).

Click here to see the background figures.

For more information:

Jan Kees Boon

Fruit and Vegetable Facts

Website: www.fruitandvegetablefacts.com

Email: [email protected]