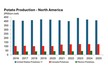

The North Carolina sweetpotato crop is down for the 2023-2024 season. The state accounts for 60 percent of the nation's crop and it's seeing its second year of reduced acreage--overall, acreage has dropped by approximately 40 percent in the past two years. "In 2021, it was 104,000 acres and in 2022, it dropped to about 84,000 acres," says Thomas Joyner, president of Nash Produce, who says it's estimated that 2023's acreage is down to 65,000 acres. "Though the quality that we are harvesting is as good as we've had and the yields are a little above average."

The North Carolina season started two weeks later because transplanting was also done two weeks later this year thanks to a cold spring. The harvest is anticipated to finish in mid-November, which is slightly earlier than normal due to those reduced acres. Meanwhile other sweetpotato potato-producing states such as California, Mississippi and Louisiana, their acreage has stayed relatively flat.

Costs and acreage

The acreage drop is largely due to costs. "Input costs continue skyrocketing and pricing didn't keep up with them so some sweetpotato growers elected to not produce in 2023," says Joyner.

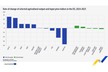

However it's also due to pressure on export demand. "The export market has dropped substantially due to competition from other countries of origin, including Egypt. Egyptian producers have ramped up their production, their costs are extremely low and according to the USDA FAS Egyptian office, their currency has been devalued twice in the last 14 months. That makes it really challenging to be competitive on pricing," says Joyner.

Meanwhile, domestic demand is good. "Retailers are recognizing what has happened over the past three years with sweetpotato pricing which didn't keep up with costs so they have begun stepping up to the plate," says Joyner.

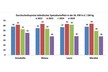

Growing consumption

At the same time, demand overall is growing, partly with the help of organizations such as the North Carolina Sweetpotato Commission and marketing groups working on increasing per capita consumption. "In the next few years, the roll out of that marketing will be pretty substantial. We're trying to increase consumption so we can get the state’s industry and pricing back to where it needs to be," says Joyner.

Domestic pricing right now on sweetpotatoes is up and more of the crop is also now contracted compared to five to 10 years ago. "Pricing is getting where it needs to get but costs continue to rise. Sweetpotatoes are harvested once a year and the crop is carried so there are carrying costs associated with it. When expenses were less, nobody said anything about it but those costs have also increased since," he says. "So will we see another increase next year? I'd anticipate so," he says. "This is a good first step on pricing increases, but I don't see it backing off. The question is will these growers who did not plant this year or reduced their acres, increase their acres again next year? Once they get this year's crop off and see what the returns are, that will determine next year's plans."

For more information:

For more information:

Nash Produce

Tel: +1 (252) 443-6011

https://nashproduce.com/