According to EastFruit analysts, the price situation on the Ukrainian onion market remains stable, while prices are rising in neighboring EU countries. In particular, in Poland, since the beginning of 2024, wholesale prices of onions have been growing fast and have already exceeded the 2023 level for this period.

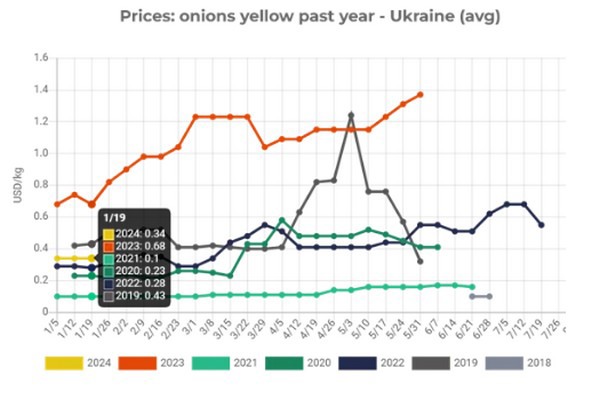

In Ukraine, onions are half as expensive as precisely a year ago. Onion prices in Ukraine are close to long-term averages, amounting to about 34 US cents per kg.

Responding to growing prices in the EU, Ukraine began exporting onions to Romania in January 2023. “Most likely, Romania, which previously actively imported onions from Moldova, switched to purchasing onions in Ukraine, since stocks of these products in Moldova began to decline and prices to rise,” says Fedir Rybalko, an international consultant on fruit and vegetable trade and logistics.

“As of today, the price of onions in Ukraine remains stable and ranges from 10 to 15 UAH/kg, which is equivalent to $0.27-0.40 US dollars per kg, depending on the quality, region, and batch size. In recent weeks, there have been many offers on the market of small and low quality onions, which, in my opinion, is the result of sorting of products for export shipments and to supermarket chains. Prices for such onions do not exceed 7 UAH/kg (US $0.19), helping ease the market tension,” says Oleksandr Khorev, FAO international expert.

It is obvious that today exports of onions to the EU countries from Ukraine are becoming profitable. This once again confirms the incredible – Ukraine was able to restore onion production in just one year, having lost up to 80% of the area and infrastructure for growing, storing and processing onions in the southern regions of the Kherson due to the barbaric actions of Russian invaders. It is quite possible that an increase in fresh onion exports from Ukraine to EU countries could support onion prices on the domestic market, especially for high-quality products. However, for prices to grow, it is necessary to significantly increase export volumes, which so far remain relatively small – within 400-500 tons per month.

For more information: east-fruit.com