The International Air Transport Association released data for global air freight markets showing that air cargo demand rebounded in 2023 with a particularly strong fourth-quarter performance despite economic uncertainties. Full-year demand reached a level just slightly below 2022 and 2019.

Global full-year demand in 2023, measured in cargo tonne-kilometers (CTKs), was down 1.9% compared to 2022 (-2.2% for international operations). Compared to 2019, it was down 3.6% (-3.8 for international operations).

Capacity in 2023, measured in available cargo tonne-kilometers (ACTKs), was 11.3% above 2022 (+9.6% for international operations). Compared to 2019 (pre-COVID) levels, capacity was up 2.5% (0.0% for international operations).

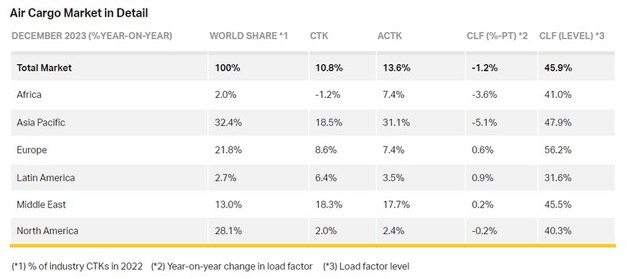

December 2023 saw an exceptionally strong performance: global demand was 10.8% above 2022 levels (+11.5% for international operations). This was the strongest annual growth performance over the past two years. Global capacity was 13.6% above 2022 levels (+14.1% for international operations).

Some indicators to note include:

- Global cross-border trade recorded growth for the third consecutive month in October, reversing its previous downward trend.

- December inflation in both the United States and the EU, as measured by the corresponding Consumer Price Indices (CPI), stayed below 3.5% year-on-year. China's CPI, however, indicated deflation for the third consecutive month, raising concerns of an economic slowdown.

- Both the manufacturing output and new export order Purchasing Managers Indexes (PMIs) – two leading indicators of global air cargo demand—continued to hover below the 50-mark in December, usual markers for contraction.

"Despite political and economic challenges, 2023 saw air cargo markets regain ground lost in 2022 after the extraordinary COVID peak in 2021. Although full-year demand was shy of pre-COVID levels by 3.6%, the significant strengthening in the last quarter is a sign that markets are stabilizing towards more normal demand patterns. That puts the industry on very solid ground for success in 2024. But with continued, and in some cases intensifying, instability in geopolitics and economic forces, little should be taken for granted in the months ahead," said Willie Walsh, IATA's Director General.

Red Sea Disruption

In November and December, air cargo experienced a modest rise in demand and yields due to disruptions in the Red Sea*. The following was observed when comparing data for the week commencing 4 November 2023 and the week ending 9 December 2023:

- A 1% increase in global air cargo demand coupled with a 5% rise in yields;

- In the Asia-Pacific region, demand grew by 2% and yields by 6%;

- A 1% increase in demand between China and the rest of the world and an 11% increase in yields;

- Europe's demand remained steady, but yields increased by 3%;

- In the Middle East, demand was constant, with a 4% rise in yields.

Data for the last half of December showed a normalization of demand and yields.

For more information:

International Air Transport Association

Tel.: +41 22 770 2967

Email: corpcomms@iata.org