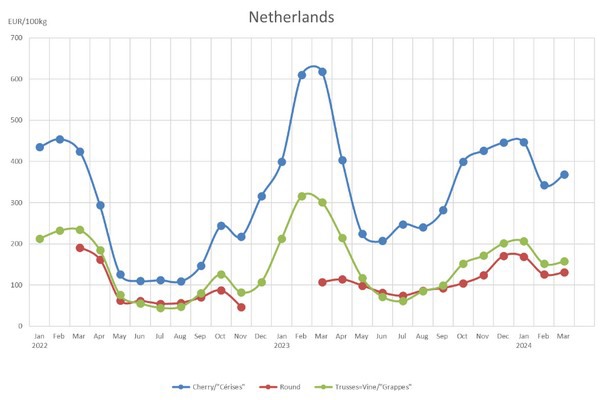

Tomato prices in the Netherlands saw a slight increase in March. However, the prices remain similar to February, lagging behind the high prices recorded in 2023 due to a lack of local production and generally a later start to the growing season.

In 2024, the situation has not normalized yet, but the fact that more growers have returned to traditional production methods hasn't led to a significant drop in prices. A possible contributing factor is that a dark spring slightly delayed local tomato production's start.

According to statistics from the European Commission in their monthly tomato price dashboard, an average of 1.57 euros was paid for a kilo of Dutch vine tomatoes in March. This represents a 4 percent increase compared to February, while the prices remain close to the five-year trend.

Compared to the five-year average, the price for cherry and specialty tomatoes in March is higher than the average over the past five years. The average kilo price on the dashboard is 3.69 euros per kilo.

The prices for regular loose tomatoes in the Netherlands averaged 1.31 euros per kilo in March. Here, there's a slightly larger deviation from the five-year average, but compared to March 2023, a year with notably higher prices, there's a 23% increase in prices for loose tomatoes in March 2024.

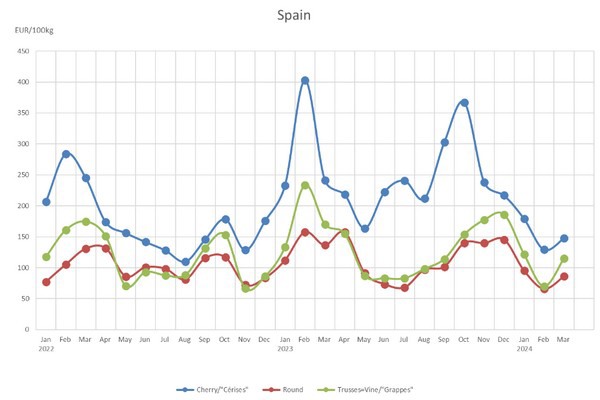

Comparing the tomato prices in March, including for Spain, Italy, and France, with those of February, shows that prices have risen almost everywhere. The only exception is vine tomatoes in France, which saw a 14% price decrease compared to February.

Across Europe, the tomato price in March stands at 1.76 euros per kilo, matching the five-year average. Particularly, the green figures on the dashboard for cherry and specialty tomatoes seem to contribute to this in March.

Import and export

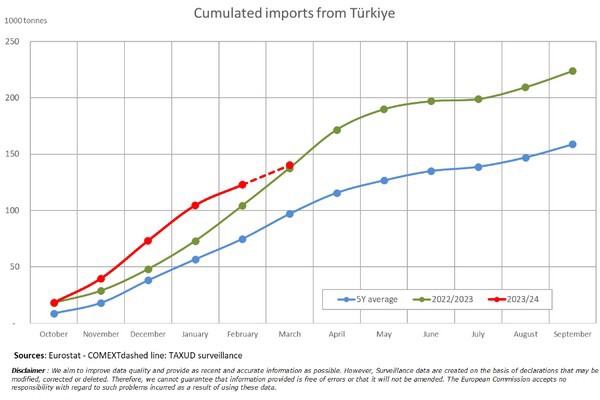

The dashboard also keeps an eye on tomato imports in Europe. The overview shows that the tonnage for imports from Morocco in March aligns with the five-year average. Particularly in January, Moroccan imports were higher than usual, while in March, the import was significantly lower.

The red line shows the import from Morocco in 2024. The green line represents the five-year average.

Turkish imports are above that average but decreased in March. "There's an opportunity for Turkish tomato exporters now as cultivation in Europe decreases," says Emel Esin Keskin, owner of Esin Tarim, on our international sister site Freshplaza.

EU tomato exports are just above the 2022-2023 level and well below the five-year average.