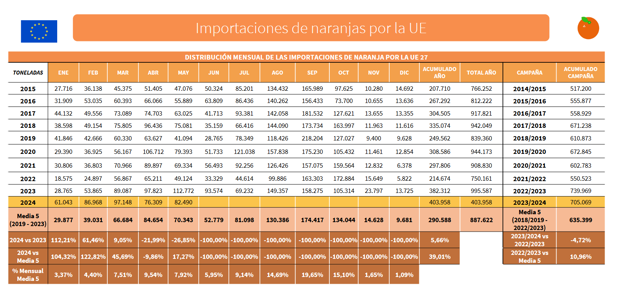

The most recent statistics regarding orange imports into the EU reveal a drop in the volumes of oranges purchased this season in April and May, which are the last two months with available data.

According to the data shared in the latest report on the reinforced monitoring of citrus imports into the EU published by the Spanish Ministry of Agriculture (MAPA), there has been a sharp change in the trend recorded since last January. The year started with the European market purchasing 112.21% more oranges than in January 2023, but in April the volumes fell by 21.99% and in May by 26.85% compared to the same months last year.

Click on the image to enlarge. Source: MAPA.

These figures have led to a cumulative 4.72% drop compared to the 2022/23 campaign, although if we look only at the months of 2024, the total remains 5.66% above what was recorded in the first 5 months of 2023 and 39% above the average for the last 5 years in that period, despite the drop in April and May.

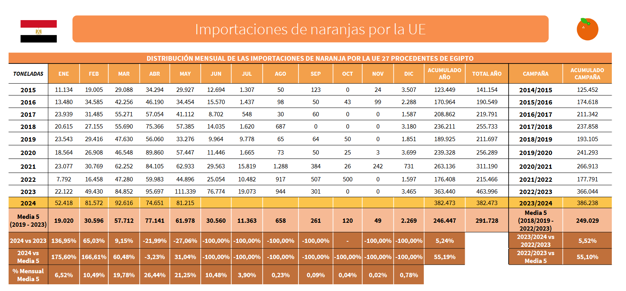

The year-on-year reduction in the volume imported from Egypt has been the main driver of this decline, with two consecutive falls of 22% in April and 27% in May compared to the same months in 2023, according to figures provided by the MAPA.

Click on the image to enlarge. Source: MAPA.

However, in the particular case of Egypt, the total volume imported this campaign (basically, the data for 2024) is 5.52% higher than that of the previous campaign, and 55.10% higher than in the previous 5 campaigns. It is worth noting that in 2024, Egyptian imports accounted for 94.7% of all oranges imported from third countries into the EU up to May.

"This decline must be a consequence of the imports in previous months and the drop in consumption. What we clearly know are the consequences," says an operator in the sector.

© Chernetskaya | Dreamstime

© Chernetskaya | Dreamstime

"Spanish companies and cooperatives are finding it very difficult to sell the Valencia oranges they still have. A few days ago, I offered Valencia to a buyer and he told me that for every kilo I could sell him, he still had two that he couldn't sell because since January it has been difficult to find an outlet for the fruit."

"There is a generalized problem with sales due to a lack of consumption," he says. "However, some products are doing a little better. At the moment, I am working with Portuguese Valencia Late oranges with leaf for the French market and they are selling, although in small quantities and slowly. Portugal delivers a very well-ripened orange and in France they appreciate the guarantee of freshness provided by the leaf."

"This is a product that faces less competition, because Morocco doesn't do oranges with leaf, nor does Egypt, and here in Spain they are not that common, so it seems that Portugal has taken a foothold on the French market with this product. In French markets, in fact, there are increasingly more Portuguese people selling fruit."

"In any case, regardless of whether we are talking about oranges with or without leaves, there still needs to be consumption, and all links in the chain must be able to make a profit. We must take into account that production costs have gone up, but everything is also more expensive for the consumer; and there are fruits and vegetables with prices that many consumers, unfortunately, cannot afford."

You can consult the full MAPA report by clicking on the following link.