Eight years ago, Vanguard Group International became vertically integrated through the acquisition of a table grape operation in Ica, Peru. Over the years, the company built a packing house and purchased additional ranches. Just recently, another 378 hectares were purchased and are being planted with new table grape varieties. "The additional land being planted now will bring our total table grape hectares to just under 1,600," says Dirk Winkelmann, President and Chief Commercial Officer of Vanguard International.

New varieties

The additional land will be planted with exciting new varieties, including Sun World's Sugra57 as well as Sugra53 red seedless grapes, known as Ruby Rush. "Next year, we expect to plant Sugra60 as well, a very exciting red variety from Sun World," added Winkelmann. "As we are on track to become one of the largest table grape growers in the Southern Hemisphere, it is critical to grow varieties that are anticipated to show the greatest demand in the coming years. The Ruby Rush red seedless variety has presented fantastic qualities and timing that will complement our Ivory green seedless variety for December and January arrivals to markets around the world," Winkelmann shared.

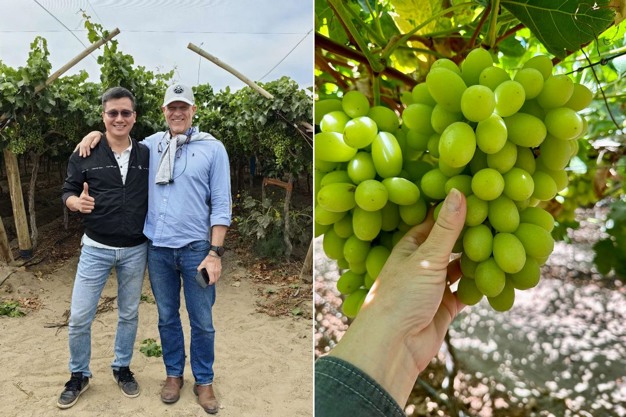

Left: Ray Wang of Shanghai Riverking. Right: Vanguard's Dirk Winkelmann.

Peru has unique climate

What is unique about Peru is both the speed and quality of table grapes coming into production. The country's climate allows for the first grapes from new plantings to be harvested next year already. "About 14 months after planting, the first crop will be harvested and the 378 hectares will provide us an additional 750,000-950,00 cartons for our core markets," Winkelmann commented. That will bring the company's total grape production volume from 4.2 million cartons expected in the 2023/2024 season to roughly 5.5 million cartons in the 2024/2025 season. With additional land acquisitions, Vanguard will reach almost 7 million cartons by the 2026/2027 season.

Blueberries

Aside from expanding its table grape production, the company will be venturing into other commodities with blueberries being first in line. In the same region in Peru, they are planning on 150 to 200 hectares of blueberries to be planted on newly acquired land. "We will be planting on a large scale as critical mass will be key in securing supply for our customers," Winkelmann said. Similar to their strategy with grapes, the blueberry variety focus will be on new genetics that are desired by retailers and drive consumer demand.

Expansion into other regions

While Winkelmann sees the benefits of expanding into other commodities, the company's executive team is taking time to figure out what is next. "Although we are currently focused on expanding our table grape and blueberry platforms, we never stop analyzing potential opportunities, whether through joint ventures or future acquisitions." Apart from different commodities, the Vanguard team also keeps their options open when it comes to expanding in different geographic locations. "One of the options we're looking at is a citrus partnership in South Africa," shared Winkelmann.

Retailers contract early

The erratic weather patterns that nowadays seem to affect multiple parts of the globe every year are changing the way retailers secure their supply. "They realize they can't rely on their domestic table grape crop for the entire season." Last year, California's table grape crop was impacted by heavy rains during harvest and this year, extreme heat is having an impact on quality and production levels of table grapes in the Golden State. As a result, the season may end early and with less volume. To secure their supply, retailers are starting to take an earlier import position. "To prevent being out of supply, major retailers appear to be contracting about two to four weeks earlier this year compared to last year," said Winkelmann.

Asia Fruit Logistica and IFPA

Aside from its owned production in Peru, Vanguard partners with more than 150 3rd party suppliers, spanning nearly 20 countries and over 50 varieties of fresh produce. The company maintains a strong market presence in Asia, the U.S., Canada, and Mexico. Significant market development has occurred over the past three years in the U.K., the European continent, and in the Central and South American markets. If you are interested in meeting the Vanguard team, visit the company at this year's Fruit Logistica event in Hong Kong from September 4-6 and/or at the IFPA in Atlanta from October 17-19.

For more information:

For more information:

Dirk Winkelmann

Vanguard International

Dirk.Winkelmann@vanguardteam.com

www.vanguardteam.com