The dynamics of the European potato market have been unpredictable since the onset of summer, with stakeholders at odds over the forthcoming primary potato season of 2024/25. The juxtaposition of seed potato challenges and unfavorable weather conditions against the backdrop of anticipated record expansion in potato acreage within the EU paints a complex picture. The Eastern European market, however, presents an even more ambiguous scenario, highlighted by Ukraine's uncharacteristic imports of food potatoes from Lithuania and Poland as of September.

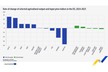

Amidst these unfolding developments, exporters from southern nations are scrutinizing their export potential to the European market as the new year looms. Notably, Egyptian exporters, as reported by EastFruit, achieved a historic high in food potato deliveries to Eastern Europe during the 2023/24 season (July-June) and are now aiming to bolster their market presence in the forthcoming season.

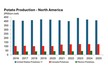

Reflecting on the European potato market's recent timeline, the North-Western European Potato Growers Foundation (NEPG) in early July highlighted the adverse weather impacts on potato cultivation across Belgium, the Netherlands, France, and Germany, alongside notable quality concerns. Despite these challenges, a 7% increase in potato acreage is anticipated by September 2024, potentially elevating production to 22.7 million tons, a near-record figure for the past five years. This projection suggests that Western Europe is poised to harvest a surplus of potatoes. Poland, too, has reported an increase in potato acreage in July, though the quality of the yield is under scrutiny due to adverse weather and the lingering effects of the seed potato market crisis.

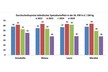

The prevailing situation hints at a potential oversupply of low-quality produce within the main EU potato market, necessitating swift sales. Meanwhile, the potato processing sector, having rebounded from the COVID crisis, faces limited prospects for volume expansion amidst a stagnant EU economy. This scenario partly explains the early attempts to expedite potato exports to the Ukrainian market, where concerns regarding production have been mounting since summer.

The Eastern European market, therefore, remains a viable target for Egyptian exporters in the new season, albeit with potential challenges such as increased competition from Western EU suppliers and the impact of the seed potato market crisis on Egypt's export-quality potato supply. Despite these hurdles, Egypt's positioning in different market segments, particularly with its "early" or "new" potatoes, sets it apart from competitors like Germany.

Source: East Fruit