On the eve of the new Spanish orange season, which will begin in Andalusia in a few days, the Ministry of Agriculture, Fisheries, and Food has published a new reinforced monitoring report on citrus imports into the EU, with advanced data for September.

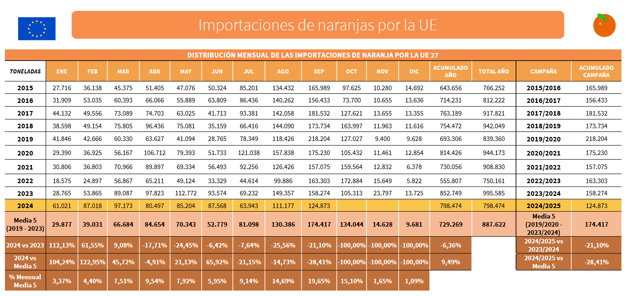

The EU started the 2024/25 season importing 124,873 tons of oranges. This is the lowest volume imported in September in at least the last 10 seasons. It is 21.1% (-33,400 tons) lower than the volume of oranges imported in September 2023 and 28.4% (-49,550 tons) below the average for September in the last five seasons.

Source: MAPA. Click to enlarge

South Africa was the main supplier of oranges to the EU-27 last month, accounting for 77% of the volume shipped. However, its shipments were down by 18.3% (-21,570 tons) over September 2023 and by 26.5% (-34,750 tons) compared to the average. This decrease in the volume of oranges exported to the Community market is in addition to those that the country has been recording since May.

The report shows that exports from other southern hemisphere countries participating in the season have also fallen. Shipments from Zimbabwe, with a 10% share, remain below the average (-6.9%, -924 tons) and shipments from Argentina fell notably (-38.5%, -4,400 tons). Morocco's shipments in September decreased by 81.6% (-4,600 tons) compared to the average of the last five campaigns.

These declines go beyond the month of September. In general, except Egypt, the major orange exporting countries have recorded decreases in their shipments to the EU so far in 2024. South Africa's figures are 26.5% (-77,600 tonnes) lower than those of 2023 and 24.7% (-70,500 tons) lower than the average; Argentina's 2024 shipments are 32.4% (-7,800 tonnes) lower than the average; and Zimbabwe's shipments are 15% lower than last year, although 7.2% higher than the average.

Egypt is the exception as, in the first nine months of 2024, it shipped 7.4% (+34,150 tons) more oranges to the EU than in the same months of 2023 - a modest figure, but on top of the 115.3% increase they experienced compared to exports until September 2022 - and 71.0% above the average.

However, according to the European Commission's Agri-Food Data Portal, the average price of the Egyptian orange on the European market fell by 5 cents/kilo for producers and marketers compared to last season because it fell in some markets and at certain times of the season (to 34 cents/kilo in Greece in June, to 36 cents/kilo on average in Malta, and to 41 cents/kilo in Ireland in March).