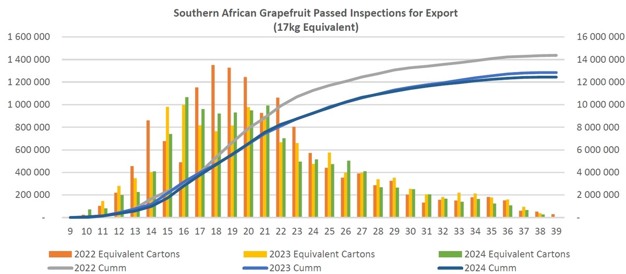

Grapefruit packing for export was estimated at 14.8 million cartons (17-kilogram equivalents), almost 14% up on last year's 13.0 million cartons. This was due to the recovery from the dry conditions experienced in the northern areas in previous years. The estimate (prepared in mid-March) also anticipated the crop will be similar to the 2022 season. The estimated volumes for 2024 include volumes available for processing (PP grade or Class 3).

The final volume packed came to 12.7 million cartons, almost 14% below the estimate. The reduction was due to several unforeseeable factors - such as small fruit size, color development challenges, and favorable local juice prices. The biggest region (Letsitele) at 4 million cartons was 20% under the estimate; Hoedspruit at 3.3 m cartons was 12% under the estimate, while Onderberg at 1.6 m was 16% under the estimate.

Red grapefruit peaked at sizes 40, 45, and 50. White grapefruit peaked at sizes 45, 40, and 50. This season the peak weeks for packing were from week 16 to week 21, at an average packing rate of 970 000 cartons per week.

The EU remains the largest market for southern African grapefruit – importing some 83,000 tonnes. China's grapefruit imports from SA have increased from 34,000 tonnes in 2023 to 36,000 in 2024. This increase is mostly attributed to the higher percentage of PP-grade fruit exported to China. Russia's imports also increased from 20 000 tonnes to 22 000 tonnes, just ahead of Japan (19 000 tonnes in 2024). And lastly, the USA (10,000 tonnes) rounds up the top five markets.

For more information:

Citrus Growers' Association

Tel: +27 (031) 765 2514

Email: justchad@cga.co.za

www.cga.co.za