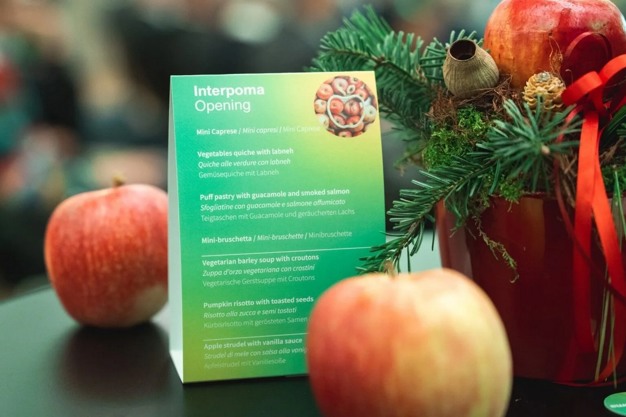

The 13th edition of Interpoma, the apple trade show, opened yesterday in Bolzano (Italy) with a deep dive into the state of the global apple market. Running through November 23, the event features key insights from industry leaders as they address shifting market dynamics, challenges, and opportunities in the 2024/2025 apple harvest, writes EastFruit.

The President of Fiera Bolzano Greti Ladurner held the opening speech and highlighted the event's importance on the world stage. She was followed by Francesco Lollobrigida, the Italian Minister for Agriculture, Food Sovereignty, and Forests, who reiterated the apple-growing industry's importance – a symbol of Italy's quality and sustainability.

The Opening Night also provided an update about international apple harvest figures, data which was first shared during the Prognosfruit in Budapest.

Philippe Binard, Secretary General of the WAPA (World Apple and Pear Association) started by sharing apple-growing figures in the European Union. He confirmed that this year's harvest was unique when compared to the previous ones – apple availability on the fresh fruits and processed fruits markets has dropped. The overall drop is mainly seen for two major varieties: Golden Delicious and Gala, which have respectively shrunk by 10% and 11% compared to 2023. However, the Red Delicious yield has increased by 20%, while new varieties have maintained the harvest record they experienced last year. Everyone agrees that the cause for this drop in yield is adverse weather which characterized the harvest season, especially spring frost which impacted most of Europe.

The YOY apple stock as of November 2024 is lower across many countries – indicative of lower yields – except for Italy, Spain, and Switzerland, whose stock levels have increased compared to the previous year. Giovanni Missanelli, Assomela, informed the audience about Italy's slightly higher yield vis-a-vis data shared in August, reaching around 2.248.000 tons, boasting overall good size and great quality. The figures for South Tyrol are in line with those from the previous year, while Trentino experienced a dip. Piedmont, Veneto, and Emilia-Romagna have registered higher numbers. Organic apple yield is in line with the 2023 harvest (7% of the total). Export-wise, European countries are performing well, especially exports to South America (including Brazil); however, there still are logistics issues due to complex geopolitical situations.

Daniel Sauvaitre, Director of the ANPP (Association National Pommes Poires) talked about France and its yield of 1.426.000 tons, a 3% drop compared to the previous year. He explained that while retail prices may be rising, they still struggle to cover production costs. Apple growers are therefore looking for systems that can increase their apples' value, relying on certifications such as sustainability labels which, however, have a direct impact on production costs.

To view the full report, click here.

For more information:

East Fruit

Email: [email protected]

www.east-fruit.com