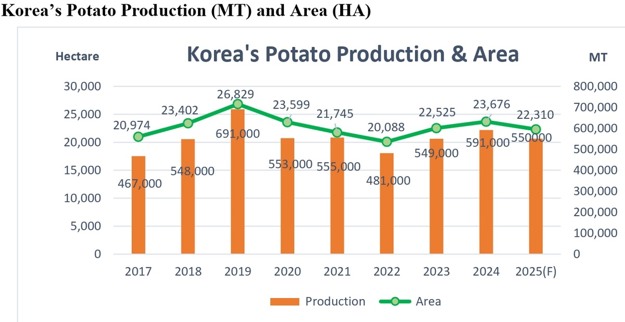

According to the Korea Rural Economic Institute (KREI), South Korea's potato production in a calendar year (CY) 2025 is forecast at 550,000 metric tons (MT) on 22,310 hectares (ha), close to the five-year average. An early 2025 planting survey suggests a 2.5% drop in open-field spring potato acreage as farmers react to falling prices caused by high 2024 production and ample stored supplies.

In 2024, production rose to 591,000 MT—up 7% from 2023—thanks to a 5% increase in planted area and favorable weather. Farmers chose potatoes over crops like cabbage and radishes, while others shifted to green onions due to higher prices following a poor 2023 harvest.

Despite recent growth, long-term trends show a decline in open-field potato cultivation, offset only slightly by increases in greenhouse production. Since 2011, total potato output has dropped by 22.6%, and cultivated area by 26%, due to an aging farm population and rising production costs. Greenhouse potato farming is expected to continue growing as the demand for fresh, high-quality produce rises, especially given climate risks like heat waves and heavy rains.

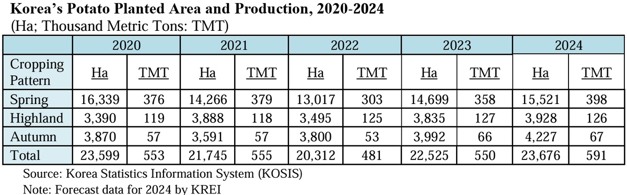

In 2024, spring potato output reached 398,000 MT, an 11% increase year-on-year, while greenhouse production rose 3.4% to 49,214 MT. Highland potato production held steady at 126,000 MT, and autumn output reached 66,000 MT.

Most Korean potatoes, especially the 'Sumi' variety, are used in traditional dishes and are unsuitable for chip processing. Processing potatoes like the 'Daeseo' variety are grown under contract for major snack companies. Local processors use domestic potatoes from May to November and import from the U.S. and Australia from December to April due to better storability.

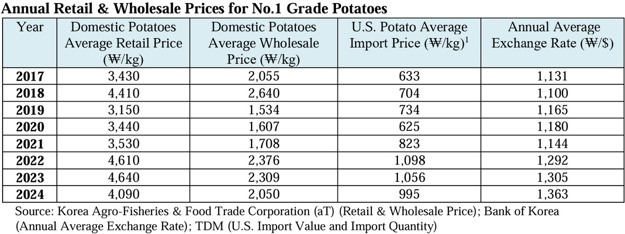

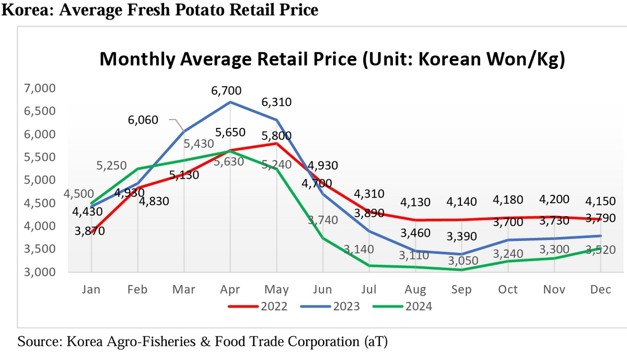

In 2024, retail and wholesale prices for fresh potatoes declined slightly due to increased output. Average retail prices fell to KRW 4,090/kg, while wholesale prices dropped to KRW 2,050/kg. Prices surged in early 2023 due to a shortage of stored potatoes but stabilized as supply improved later in the year.

Per capita potato consumption rose to 15.8 kg in 2024, driven by strong domestic supply, up from 14.9 kg in 2023. While food service demand for processed potatoes remains weak, consumption is growing in snack and home meal markets.

Potato imports, including fresh and processed products, fell 5.2% to 184,422 MT in 2023 due to high global prices and a rebound in local production. Fresh potato imports increased 4.5% to 42,000 MT, aided by a tariff rate quota allowing 13,000 MT of duty-free chip potatoes.

Despite short-term gains, aging demographics and rising costs are likely to constrain long-term production, with imports expected to play a larger role in meeting demand.

To view the full report, click here.

For more information:

For more information:

USDA

Tel: +1 202 720 2791

Email: press@usda.gov

www.usda.gov