Weston Holdings, Inc. announced its fiscal third quarter 2023 results and updated its fiscal 2023 outlook.

“We  delivered another quarter of strong operating results and have raised our fiscal 2023 financial targets accordingly,” said Tom Werner, President and CEO. “Our performance was broad-based, with strong sales and earnings growth across each of our core business segments that were in line with or exceeded our projections for the quarter."

delivered another quarter of strong operating results and have raised our fiscal 2023 financial targets accordingly,” said Tom Werner, President and CEO. “Our performance was broad-based, with strong sales and earnings growth across each of our core business segments that were in line with or exceeded our projections for the quarter."

"We expect this momentum will continue through this fiscal year and provide a solid foundation for fiscal 2024. However, we continue to believe that the near-term macroenvironment in North America and Europe will remain volatile as we face higher costs for raw potatoes and other key inputs, and as consumer demand and restaurant traffic continue to be affected by inflationary pressures. Longer term, we believe we are well-positioned to drive sustainable, profitable growth, and to better serve customers around the world as we leverage the commercial and operational benefits of our recently-acquired European operations, as well as our capacity expansion investments in the U.S., China, Argentina, and the Netherlands.”

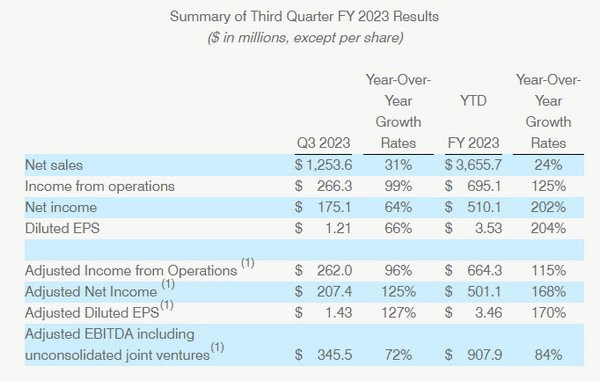

Net sales increased $298.6 million to $1,253.6 million, up 31 percent versus the prior year quarter. Price/mix increased 31 percent, reflecting the benefit of pricing actions across each of the Company’s core business segments to counter input and manufacturing cost inflation. Overall volume was flat as solid growth in shipments to large chain restaurant and retail channel customers in North America offset the impact of exiting certain lower-priced and lower-margin business as the Company continues to strategically manage customer and product mix due to capacity constraints. To a lesser extent, softer traffic at casual dining and full-service restaurants in North America also affected volume.

Income from operations increased $132.5 million to $266.3 million, up 99 percent versus the prior year quarter. Adjusted Income from Operations(1), which excludes items impacting comparability, increased $128.2 million to $262.0 million, up 96 percent versus the prior year quarter. The increases were driven by higher sales and gross profit, partially offset by higher selling, general and administrative expenses (“SG&A”).

Gross profit increased $176.8 million versus the prior year quarter to $397.8 million, as the benefits from pricing actions more than offset the impact of higher manufacturing costs on a per pound basis. The higher costs per pound primarily reflected double-digit cost inflation for key inputs, including: raw potatoes, edible oils, ingredients such as grains and starches used in product coatings, labor, and energy. In addition, the increase in gross profit included an $8.7 million decrease in unrealized mark-to-market adjustments associated with commodity hedging contracts, reflecting a $5.1 million loss in the current quarter, compared with a $3.6 million gain related to these items in the prior year quarter.

For more information: news.lambweston.com