Analysts at EastFruit think that the potato price rise is unlikely in Georgia in the near future. May is a transitionary period when the Georgian market switches from last year’s potatoes to the potatoes from the new harvest. Sometimes, when the previous harvest, which mainly takes place in September-October in the Samtskhe-Javakheti region, is not enough till the new harvest enters the market in full force, the potato prices go up. Interestingly, harvest in the mentioned region was bad in 2022, but the prices have remained stable.

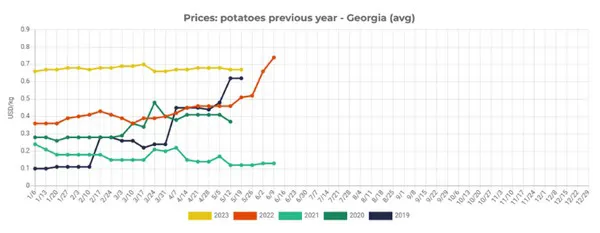

The average price for the last year’s potatoes on the Georgian wholesale market has been fixed at about $0.67/kg and it is showing no signs of growth. There are two main reasons: prices are already very high, and potato imports are very strong.

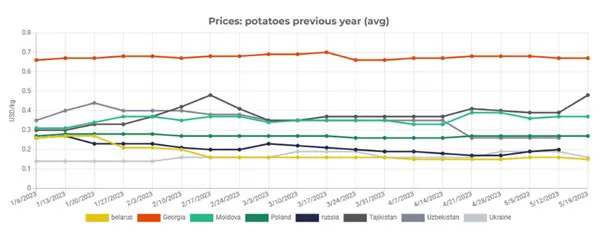

Due to the poor harvest in the Samtskhe-Javakheti region in 2022, potato prices have gone up in October. The average price has been stable but at a record-high level since then. Raising prices even higher is very likely to be problematic – Georgian consumers are already paying a very high price, are they ready to pay even more? Probably not. The average wholesale price in Georgia remains the largest within the EastFruit project:

The price difference has opened up opportunities for the Georgian importers and they have used these opportunities quite well. Starting from October 2022 to the end of April 2023, the country has imported slightly more than 27 thousand tons of potatoes, which is the second-largest import volume for the period at least since 2015. The average import volume of the previous nine seasons for October-April stands at much lower 12 thousand tons. Importing large volumes of potatoes has been keeping prices in Georgia at high, but stable levels. Without importing, potatoes would have become much more expensive, especially in the transitionary period.

There are several big reasons for potato prices to reduce in Georgia. Firstly, the potatoes from the new Georgian harvest have started to enter the market. This will of course put negative pressure on the prices: more potatoes, lower the prices. Potatoes are still cheaper in the region than in Georgia, so the countries in the neighborhood still have the opportunity to export to Georgia. Which also reduces the possibility of price increases.

Right now, the main potato exporters to Georgia are Russia and Belarus, but Turkey may make a comeback. Turkey which generally was the main importer has limited the exports to fight inflation, but with the new season, this might change. Inflation in Turkey is still high, however, the Turkish early harvest is said to be quite rich and there may be incentives to export, possibly to Georgia – if the price difference remains, why not? According to AgroPrice.net, the average wholesale price in Istanbul, Turkey, is $0.34/kg at the moment.

For more information: east-fruit.com