According to a recent RaboResearch report, the U.S. pistachio industry is poised for a significant supply increase.

Over the past two decades, pistachios have consistently offered higher gross returns per bearing acre than almonds and walnuts in California. With average gross returns of USD 6,400 per acre over the past decade, pistachios have outperformed almonds and walnuts by 20 percent and 70 percent, respectively. This profitability, coupled with the resilience of pistachio orchards to salinity and drought, has spurred rapid planting growth since 2012. From 2011 to 2023, California's pistachio-planted area increased by over 372,000 acres, with projections suggesting a bearing area of 590,000 acres by 2028. However, industry-wide challenges, such as the Sustainable Groundwater Management Act (SGMA) in California, are expected to limit new plantings.

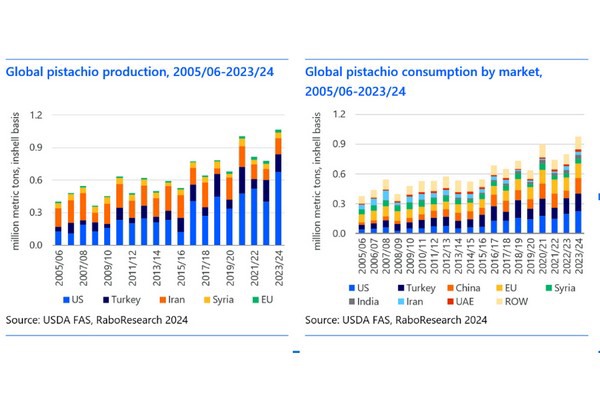

Since 2016/17, the U.S. has accounted for 63 percent of global output in 2023/24. "This growth is a result of steadily expanding bearing acreage, with the U.S. outpacing the other major producer, Iran," says David Magaña, senior analyst – fresh produce and tree nuts for RaboResearch. In 2023/24, Turkey and Iran accounted for 15 percent and 14 percent of the global pistachio crop, respectively. U.S. production grew at a compound annual growth rate (CAGR) of 10 percent over the past decade, significantly higher than the global CAGR of 5 percent.

The U.S. has also become the largest consumer of pistachios since 2019/20, surpassing previous leaders like Turkey and the EU. U.S. pistachio consumption soared from 41,500 metric tons in 2005 to 225,000 metric tons in 2023/24. The four key markets for pistachios are the U.S., Turkey, China, and the EU, which account altogether for 72 percent of global pistachio consumption. "Over the past decade, pistachio consumption has increased in the U.S., Turkey, China, and the EU, expanding at CAGRS of 13 percent, 7 percent, 5 percent, and 6 percent, respectively," says Magaña. "In India, a country that absorbs 4 percent of the world's pistachios, consumption has expanded at 11 percent CAGR in the past ten seasons."

"Over the past decade, pistachio consumption has increased in the U.S., Turkey, China, and the EU, expanding at CAGRS of 13 percent, 7 percent, 5 percent, and 6 percent, respectively," says Magaña. "In India, a country that absorbs 4 percent of the world's pistachios, consumption has expanded at 11 percent CAGR in the past ten seasons."

The U.S. has emerged as the dominant exporter, with exports reaching a record 390,000 metric tons in 2023/24, representing 70 percent of global exports. Major importers include China, the EU, Turkey, and India, with Middle Eastern markets also showing significant growth in the past decade.

For the 2024/25 season, initial prices are expected to remain steady, with potential improvements due to a shorter crop. Strong shipments/lower supplies could lead to very low inventories, supporting prices into the 2025/26 season. The average price estimate for 2024/25-2028/29 is around USD 2.10 per in-shell pound, with an 80 percent chance of prices ranging between USD 1.80-USD 2.20 in 2027/28.

Click here for more on the report.

For more information:

For more information:

Melanie Bernds

Rabo AgriFinance

[email protected]

https://research.rabobank.com/