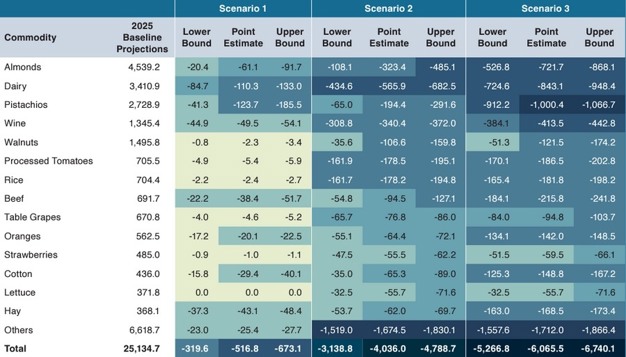

As protectionist policies gain momentum in the United States, the future of California's agricultural trade faces pessimism. With proposals to expand tariffs on imports from China and other nations, California farmers—who depend on global markets as an outlet for their almonds, wine, and other agricultural goods—are aware that there would be trade retaliation from our trading partners. If a significant new trade war develops, California could see a quarter of its agricultural exports wiped out, costing the state's economy $6 billion annually.

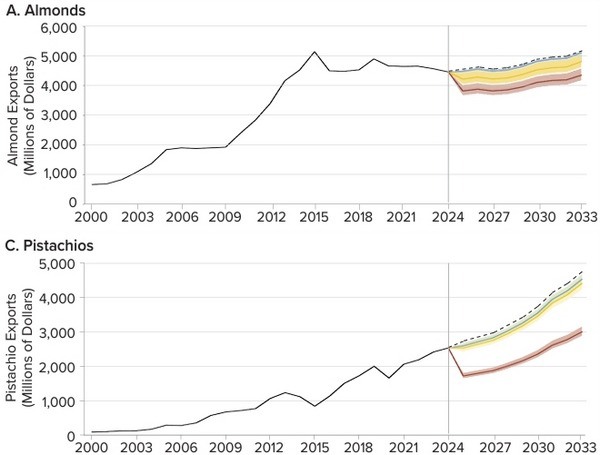

Over the last two decades, California's farmers have built strong trade ties with China, which became a critical market for the state's agricultural products after China joined the World Trade Organization (WTO) in 2001. By 2023, California's value of yearly agricultural exports to China soared to more than $2.6 billion, up from just $0.2 billion in 2002. This boom in trade has been incredibly beneficial for high-value crops like almonds, a sector that doubled its bearing acreage over the past 20 years due to profitable returns. However, the threat of expanding U.S. protectionism now casts a long shadow over this success.

Recently, California's farmers have experienced financial losses due to trade wars. When the U.S.-China trade conflict was initiated in 2018 during the Trump administration, China retaliated with tariffs on U.S. agricultural goods, hitting California's top farm exports hard. Almond prices, for example, fell from $2.50 per pound before the trade war to just $1.40 per pound during the trade war. While midwestern farmers received significant federal subsidies to cushion the trade war blow they experienced, for political reasons, California's farmers were largely left out of the government compensation schemes.

Some of the most vulnerable commodities are pistachios and almonds, all of which heavily depend on China's import demand. In contrast, commodities like lettuce, grapes, and strawberries, which are less reliant on the Chinese market, are projected to be more resilient under higher tariffs.

Fresno, Kern, Tulare, Merced, and Imperial counties, which are key producers of almonds, beef, cotton, dairy, grapes, oranges, and pistachios, are expected to bear the brunt of these losses. Together, these five counties account for 53% of the estimated total state-level export loss. In the worst-case scenario, Fresno and Kern counties could face combined losses of up to $710 million from pistachio exports alone.

The last U.S.-China trade war showed just how much California agriculture can lose in such conflicts. Between 2018 and 2019, a trade war led to retaliatory tariffs that caused exports and prices for agricultural commodities to plummet, resulting in billions of dollars in lost revenue. If a new wave of aggressive protectionist policies is enacted, California's agricultural exports could face similar consequences—up to $6 billion in annual losses.

To read the full report, click here.

For more information:

Colin A. Carter

Giannini Foundation of Agricultural Economics

Email: [email protected]

www.giannini.ucop.edu