Lineage, a global temperature-controlled warehouse REIT, today announced its financial results for the third quarter of 2024.

Third-quarter 2024 highlights

Raised $5.1 billion in gross proceeds from the Company's July 2024 IPO, marking the largest IPO of the year and the largest real estate IPO of all time

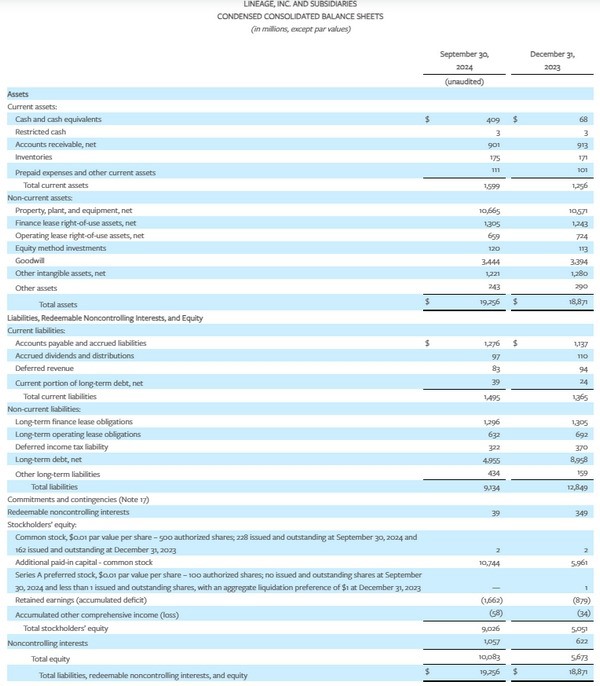

Total revenue increased 0.5% to $1.3 billion

Net loss of ($543) million, or ($2.44) per diluted common share

Total NOI increased 2.1% to $439 million

Adjusted EBITDA increased 5.4% to $333 million; adjusted EBITDA margin increased 110bps to 24.9%

AFFO increased 51.8% to $208 million; AFFO per share increased 20.0% to $0.90

Used IPO proceeds to reduce $4.9 billion of debt; achieved investment-grade credit ratings from Fitch and Moody's.

Declared initial quarterly dividend of $0.38 per share, representing an annualized dividend rate of $2.11 per share.

Opened a new, fully automated cold storage warehouse in Hazleton, PA, the newest addition to Lineage's automated facility portfolio backed by proprietary software and in-house automation teams.

Acquired ColdPoint Logistics for $223 million on November 1st, expanding Lineage's existing presence in the strategic Kansas City market

"We are excited to report strong results for our first quarter as a public company, demonstrating our ability to perform well in various economic environments," said Greg Lehmkuhl, president and chief executive officer of Lineage, Inc. "We generated significant AFFO per share growth this quarter aided by our successful IPO and continued strong operating performance. Looking forward, we are well-positioned to drive compounding growth, benefiting from our industry-leading real estate portfolio, innovative technology, and our strategic capital deployment engine. To that end, we are pleased to announce the acquisition of ColdPoint Logistics and we are excited to welcome them to the Lineage family."

2024 outlook

The Company expects full-year 2024 Adjusted FFO ("AFFO") per share of $3.16 to $3.20.

For the fourth quarter of 2024, the Company expects AFFO of $180 to $190 million, AFFO per share of $0.70 to $0.74, and low single-digit same warehouse NOI growth.

The Company's outlook excludes the impact of unannounced future acquisitions or developments.

To view the full report, click here.

For more information:

Megan Hendricksen

Lineage

Email: [email protected]

www.ir.onelineage.com