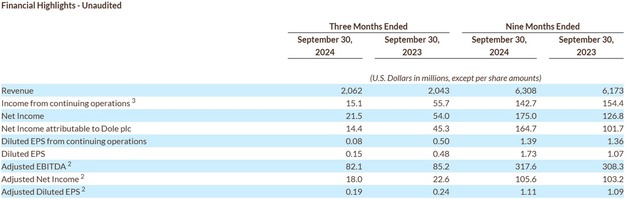

Dole reported positive third-quarter results for the three months ended September 30, 2024, positioning it for a strong full-year performance. Revenue reached $2.1 billion, reflecting a 1.0% increase, or 5.8% on a like-for-like basis. Despite a decrease in net income to $21.5 million—attributable to a $28.8 million one-time gain from the sale of a non-core asset in the prior period—the company saw growth in key operational metrics. Adjusted EBITDA stood at $82.1 million, a 3.7% decline overall but a 2.3% increase on a like-for-like basis. Adjusted net income was $18.0 million, with adjusted diluted EPS at $0.19. The company has raised its full-year adjusted EBITDA guidance by $10.0 million, now targeting at least $380.0 million.

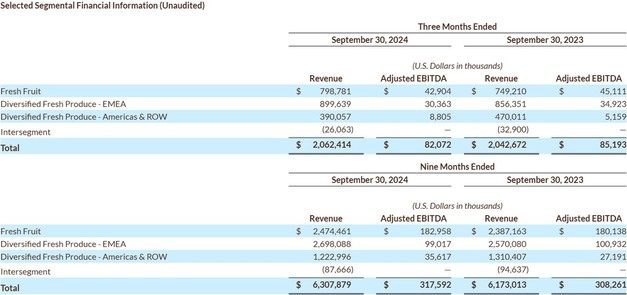

Fresh Fruit

Revenue increased 6.6%, or $49.6 million, primarily due to higher worldwide volumes of bananas sold, as well as higher worldwide pricing of bananas and pineapples, partially offset by lower worldwide volumes for pineapples and lower pricing and volume for plantains.

Adjusted EBITDA decreased 4.9%, or $2.2 million, primarily driven by higher shipping costs in the North American market due to scheduled dry dockings as well as lower volumes of pineapples sold and lower commercial cargo profitability, partially offset by higher volumes of bananas sold and higher pricing for bananas and pineapples.

Diversified Fresh Produce – EMEA

Revenue increased 5.1%, or $43.3 million, primarily due to strong performance in Ireland, the U.K. and the Netherlands There was also a favorable impact from foreign currency translation of $13.6 million and an incremental positive impact from acquisitions of $1.8 million. On a like-for-like basis, revenue was 3.3%, or $27.9 million, ahead of the prior year.

Adjusted EBITDA decreased 13.1%, or $4.6 million, primarily due to a decrease in the U.K. due to higher one-off IT charges and the impact of lower supply of certain categories and seasonal timing differences in Spain and South Africa. On a like-for-like basis, Adjusted EBITDA was 14.5%, or $5.1 million, behind the prior year.

Diversified Fresh Produce – Americas & ROW

Revenue decreased 17.0%, or $80.0 million, primarily due to the disposal of the Progressive Produce business in mid-March 2024. On a like-for-like basis, revenue was 7.2%, or $33.6 million, ahead of the prior year, primarily due to volume and pricing growth in most commodities in North America.

Adjusted EBITDA increased 70.7%, or $3.6 million, primarily driven by improved performance in our North American berries business and positive margin development in avocados, as well as revenue growth across most commodities in North America. These positive impacts were primarily offset by the disposal of the Progressive Produce business. On a like-for-like basis, Adjusted EBITDA was 178.1%, or $9.2 million, ahead of the prior year.

To view the full report, click here.

For more information:

Brian Bell

Dole

Tel: +353 1 887 2794

Email: [email protected]

www.doleplc.com