Chinese New Year (CNY) 2025 falls on January 29, just over three weeks away, coinciding closely with the launch of new carrier alliance networks. This timing may intensify the usual supply chain disruptions caused by CNY-related blank sailings, as the transition from existing alliance services to new networks could further impact capacity and scheduling.

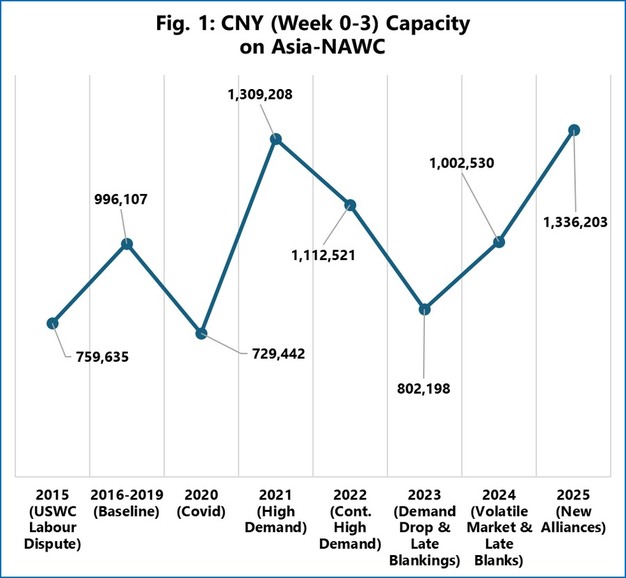

On the Asia–North America West Coast trade lane, a significant capacity increase is projected for the 4-week CNY period (the week of CNY and the three weeks following). Current deployment for 2025 is nearly 1.34 million TEU, marking the highest level across the analyzed period and surpassing even the high-demand conditions of 2021. This represents a year-on-year increase of 33.3% and a 34.1% rise compared to the 2016–2019 average, despite no clear demand growth to justify this surge.

Scheduled blank sailings for 2025 account for just 9.0% of capacity, the lowest across the analyzed period. This is a stark contrast to 22.8% in 2024 and an average of 18.3% for 2016–2019. Even during the demand surge of 2021, blank sailings reached 10.7%. Under normal circumstances, carriers would likely announce further blank sailings in the coming weeks to manage excess capacity, mirroring the significant last-minute capacity cuts seen in 2023 and 2024.

However, the introduction of new networks by MSC, Gemini Cooperation, and Premier Alliance adds a layer of uncertainty. Carriers may prioritize phasing vessels into these new services over cutting capacity, potentially leading to fewer blank sailings than usual. This dynamic could result in unexpected supply chain conditions during and after CNY 2025.

For more information:

For more information:

Sea-Intelligence

Email: [email protected]

www.sea-intelligence.com