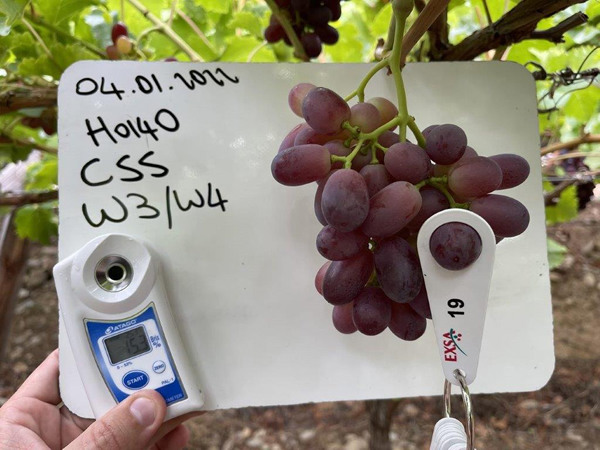

An unusual phenomenon, which occurs once in a blue moon, is currently happening with South African grapes. "The grapes are big enough but don't weigh enough. Each grape is a gram or two too light. Walking through the vineyards, the production seems good, but when packing, the growers are 20-25% short," says Eddy Kreukniet of the Dutch company Exsa Europe.

This year's overseas season began excellently. "Supply was very sparse, certainly until Christmas. Brazil sent 35% fewer grapes, and, at the start, Peru definitely sent fewer too. The European season had also ended early, so, the market was great. Until Christmas. After that, sales quieted down considerably. South Africa shipped good volumes for several weeks, but that decreased significantly in the last two or three weeks."

Knock-on effect

"The next few weeks could also be odd loading weeks. That's because the later production areas are considerably earlier. The early areas' lesser production could thus create a kind of knock-on effect, making this season's statistics look very different. For red and blue grapes, despite the lesser weight, normal volumes are expected to come to Europe in the coming weeks, and there could theoretically be a shortage of white grapes," explains Eddy.

"Fortunately, last year's shipping disruptions around this time haven't repeated this year. The shipping companies have focused heavily on that, so arrivals are far more stable. That was much needed too, because last year, the delays shortened the grapes' shelflife by two weeks, even before they arrived."

"This year, the grapes generally have good quality. In South Africa, the production areas in Limpopo and Mpumalanga did suffer a bit from the weather, so the quality varies. But the grapes from the Orange River area, the Western Cape, and Namibia are excellent," Eddy states.

"Prices have since returned to normal, but still good, levels. That's much needed, given all the costs in the chain. Besides all the cost price increases in the production areas and here, sea freight costs from South Africa and Peru are still much higher. The weak dollar doesn't help either."

India started later

"India began tentatively exporting but stopped again because of the strong local market and the grapes' too-low Brix levels. These exports will pick up in the coming weeks," Kreukniet says, "but India's season is late by at least two weeks. Indian grapes have the advantage of back-to-normal sea freight prices, which are half what they were last year."

© Exsa Europe

© Exsa Europe

"With the economic situation being what it is, price is an important factor. The big question is whether people are willing to pay the higher price. That, however, applies to all products, whether it be local iceberg lettuce or overseas fruit. Until the end of last year, grape suppliers weren't all that willing to act because the volumes weren't there. For January, though, quite a few promotions are planned. The whole market is under pressure to have sales, so these promotions are undoubtedly needed to sell all the volumes," Eddy concludes.

For more information:

For more information:

Eddy Kreukniet

Exsa Europe

Tel: +31 (0) 887 350 003

Mob: +31 (0) 620 257 811

Email: [email protected]

Website: www.exsaeurope.com