“The year ended with inflation taking the headlines,” said Jonna Parker, team lead, fresh at IRI. “According to the December IRI primary shopper survey, 93 percent believe groceries cost somewhat/a lot more than last year and 97 percent are somewhat/a lot concerned about it — lower-income households in particular.” Amid the continued disruption, IRI, 210 Analytics and IFPA remain committed to bringing the latest trends and analysis in fresh produce.

The survey found inflationary pressure on income is real: 43 percent of consumers say their current financial situation is worse than last year. Additionally, 31 percent expect it to be worse a year from now versus 27 percent who believe it will be better.

The survey found inflationary pressure on income is real: 43 percent of consumers say their current financial situation is worse than last year. Additionally, 31 percent expect it to be worse a year from now versus 27 percent who believe it will be better.

The December IRI survey also noted a sharp uptick in the estimated share of meals prepared at home. These meals started to rise in September and jumped from 78.9 percent in November to 81.5 percent in December. “Cutting back on restaurant spending is also a popular way to save for many, according to the December IRI survey,” said Parker.

Lunch is one area consumers are looking to save on restaurant meals. Among people working away from home, 38 percent packed lunch more often. “In-store merchandising and recipe ideation often go after dinner,” said Joe Watson, IFPA’s VP, retail, foodservice and wholesale. “Between more people working from home versus pre-pandemic and people identifying lunch as an occasion to save, retailers have an opportunity to go after fast, healthy and cost-effective solutions.”

High inflation, continued supply chain challenges and fluctuating restaurant engagement resulted in another year of record food and beverage sales, reaching $753 billion in 2022.

High inflation, continued supply chain challenges and fluctuating restaurant engagement resulted in another year of record food and beverage sales, reaching $753 billion in 2022.

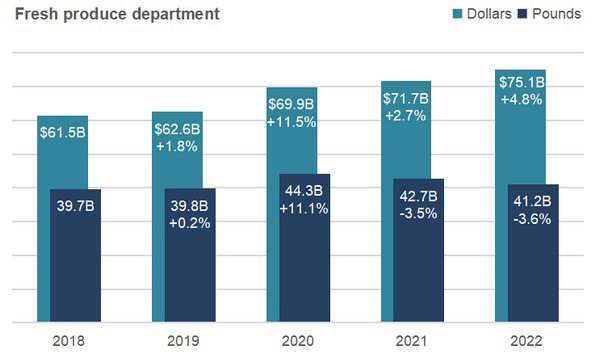

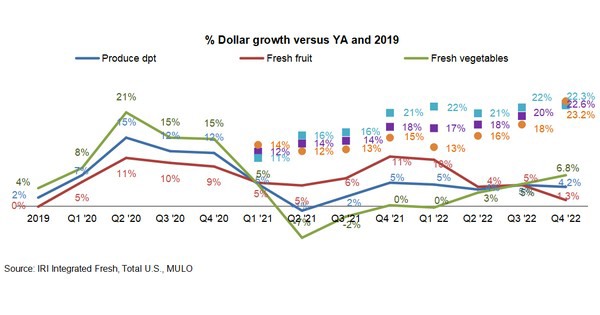

“Fresh produce also set new records in dollar sales, but saw units down 3.6 percent," said Watson. Volume (in pounds) is still well ahead of 2019, the pre-pandemic normal.

December 2022 fresh produce sales reached $5.5 billion, surpassing the record set the prior year by +4.4 percent. “December closed out the year in a strong way. Fruit sales were up in units and vegetables up in pounds as celebrations remained home-centric.”

The last two weeks before the holiday were big for fresh produce, topping $1.5 billion.

“Despite the strong December results, the growth in fresh produce dollars was far below the levels seen in canned and frozen,” Watson said.

“Berries dominate the top 10 fresh fruit sellers list, both in December and for the calendar year,” said Parker.”

“Onions and cucumbers stand out in annual the top selling vegetables with positive pound sales,” said Watson. “But potatoes deserve a call out too.”

In 2022, fresh fruit added $2.0 billion in additional dollars versus 2021 and fresh vegetables added $1.4 billion.

The next report, covering January, will be released in mid-February.

Please contact Joe Watson at [email protected] with questions. Click here to read the full report.

For more information:

For more information:

Anne-Marie Roerink

210 Analytics LLC

Tel: +1 (210) 651-2719

[email protected]

www.210analytics.com