Despite strong growth showing positive signs for many growers in several individual categories, mixed performance across the sector saw the overall value of the Australian fruit sector fall four per cent over the past financial year.

The Australian Horticulture Statistics Handbook found that for the financial year ending June 2022, the value for fresh fruit production was $5,52million, and more than 2.55 million tonnes in terms of volume.

Hort Innovation Industry Analyst Lucy Noble noted that there is a high degree of concentration for the production share of fruit commodity groups with the berry, citrus and table grapes driving nearly half of the total value for fruit, with the addition of apples, bananas and avocados taking the share to nearly three quarters.

"It has been a weakening year for the fruit category, declining $237.2million, with the volume also declining but marginally," Ms Noble said. "A decline in the fruit farmgate production value was driven by losses seen in avocados, bananas, apples, berries (particularly Rubus) and oranges. Having said that, several fruit categories did expand; table grapes, watermelons, mangoes, mandarins, lychees, and nectarines and peaches."

Mango volumes increased 10 per cent on last year and reached the highest year of production value, recording $217.9million, with a ten per cent increase in volumes to 68,600 tonnes. Exports of mangoes were also up, to 4,747 tonnes ($26.3m).

As well as mangoes, table grapes also saw an increase in value.

"In light of the decrease in exports this last year; tables grape export value is back 4.5 per cent and export volume is back 10.4 per cent, I think there is a story of real optimism in there as well," Ms Noble said.

"So, while the value of exports reduced (at a lesser rate than export volume), the fresh domestic market absorbed the increase in supply, with the value of table grapes into that retail channel increasing 40 per cent. So, what this says is despite some pronounced challenges in trade, particularly seen in table grapes, the difference in the supply of presumably higher value and higher quality product that has previously been sold at a premium through export was able to be supported and absorbed by some really strong growth in the domestic value channel. So that's an incredibly encouraging story, following on from the work done in the industry to get those results."

Oranges fell four per cent in value to $420.7million despite a six per cent jump in volume. Orange volumes recovered six per cent from last year's low to reach 501,072 tonnes - despite this, the value of oranges has seen it become the fourth-highest fruit category. Over the past five years, orange production value has increased by $87million.

While in the entire berry category, production was down 13 per cent to 97,551 tonnes - which was a drop of two per cent to $1.03billion.

"Berry volumes softened across the reporting period, across all varieties; blueberries, rubus and strawberries," Ms Noble said. "The rate of decline for volumes was greater than it was for values. The 2021-22, farmgate value per kilogram increased by 18 per cent for blueberries, 14 per cent for strawberries and four per cent for rubus. Despite the softening of production values, blueberry and rubus values continue to have the second and third-highest five-year annual compound growth rate behind avocados. So, what means is reduced production volumes have resulted in a reduced per capita supply across the three varieties meaning the availability to Australians has been at its lowest level in four years."

One of the biggest decreases was in avocados where there was a 26 per cent decline in the value of production (to $363.8m), despite a 56 per cent in volume (up to 122,197t) for the year ending June 2022. Export volumes were significantly up to 11,611 tonnes from 3,155 tonnes the previous year, and export value was also up from $22million to $52million.

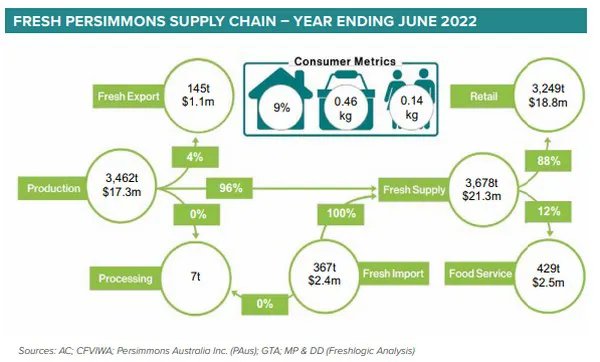

New production value highs were achieved for the third consecutive year for some of the smaller categories, with persimmons increasing by 56 per cent to $17.3million, Lychees up 31 per cent to $41.9million and custard apples up seven per cent to $8.4million.

The Australian Horticulture Statistics Handbook also contained information on the protected cropping industry for the first time.

"It's just such a big part of horticulture now," Managing Director of Freshlogic, Martin Kneebone said. "The capacity to control the environment, get a better yield and do a better job of what you are doing is the norm. So, varying levels of protected cropping are a part of most crops. Our challenge initially was what exactly was possible as a first step, and we narrowed that down to glasshouses and polyhouses and tunnels. There were discussions about whether we could cover shade cloth, but that was difficult because of the different ways they were used, so we narrowed it down to those two and have attempted to do that for these products. But I think it will continue to expand, and protected cropping will go beyond the base of vegetables and across to the fruit and berry crops, where the investment is high but we know the returns are there when pack outs and yields go the right way."

To view the full Australian Horticulture Statistics Handbook 2021/22, click here.

For more information

Hort Innovation

Phone: +61 2 8295 2300

[email protected]

www.horticulture.com.au