The sweet potato campaign kicks off on July 15 in Egypt, on a background of strong demand and increased production, announces Amr Kadah, export manager at HB Group For Import And Export.

"We're expecting a great campaign," enthuses the producer, "There's strong demand for Egyptian sweet potatoes, and we're receiving orders even before the harvest begins. Customer visits to Egypt, particularly by supermarkets, have multiplied recently, and exporters have already signed contracts."

"Demand comes mainly from Western Europe and Russia for the Beauregard variety, and from Arab countries for Red and White sweet potato," explains Amr. "In Europe, demand is very strong from the Netherlands, the UK, France, and Russia. In Asia, demand comes mainly from Arab countries such as Saudi Arabia, UAE, Oman, and Bahrain. We also export part of our volumes to East Africa. A novelty of this campaign is there is a new demand from customers in Portugal who want to join Poland as a hub for re-exporting Egyptian sweet potatoes to Europe."

In terms of production, "everything is going well and we're getting ready to harvest in two weeks. The weather conditions have had no impact on the potatoes. Growers have done a good job of selecting seeds of the most yield-generous and most in-demand varieties. The cultivated acreage has increased by 20% compared with last year, and we expect to harvest 150,000 tonnes nationally, compared with 130,000 tonnes last year."

The main difficulty that Egyptian growers have encountered, according to Kadah, is the soaring cost of production. He explains, "Because of the devaluation of the Egyptian pound, all prices have rocketed, whether it's seeds, inputs, fertilizers, logistics and transport, and so on. We've particularly taken the brunt this season in terms of production costs."

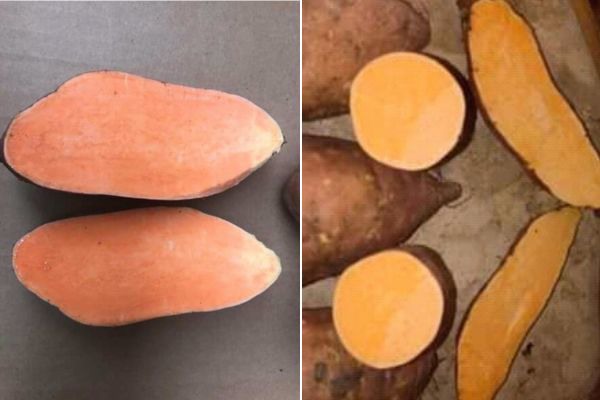

Egypt, a major origin of sweet potatoes, is in competition with China, India, and the United States. Yet, "Egyptian exporters are doing well," says Kadah. "Egyptian sweet potatoes have proven their worth. The U.S. has exporting calendars different from Egypt's and enters the market several months before we do. We're also very competitive thanks to the superior quality of the varieties we produce, and a rich taste. China, on the other hand, has a stranglehold on certain markets."

"At HB, we have a great capacity to meet the demands of European markets, including supermarkets, with unquestionable quality and the suited sizes of 200-800g. We have a solid demand from our regular customers in Europe, Russia, and the Arab countries, and welcome any customer to start working with us, with very good prices."

"We have also developed an export activity for frozen sweet potatoes. There's an emerging and growing demand for them, and it's an industry that will certainly grow in the years to come," concludes Kadah.

For more information:

Amr Kadah

HB Group For Import And Export

Tel: +20 100 928 8377

Email: amr.kadah@hbgroup-eg.com

www.hbgroup-eg.com

linkedin.com/in/amr-kadah