At the end of September the South African Table Grape Industry (SATI) released its first crop estimate of 73.0 million cartons (4.5 kg equivalent) for the 2023/24 season. Buyers use these types of estimates to plan their orders to keep shelves stocked at all times, as well as marketing campaigns to move excess volumes. “Despite their importance, the reliability of crop estimates is not always well understood,” says Dr. Adam Formica, the head of R&D at Sensonomic.

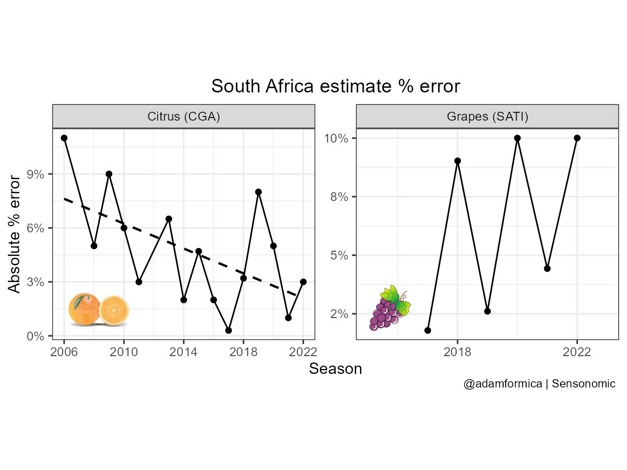

SATI publishes its estimates and actual harvest numbers for each year separately in press releases and annual reports. The Citrus Growers Association (CGA) of South Africa publishes them together, and quantifies accuracy in its annual report. Neither show how the accuracy has evolved over time. “By not making these trends explicit, they miss the opportunity to discuss how they can improve accuracy,” states Formica.

A new analysis by Formica, who is based in Norway and does extensive predictions through their online platform for industries around the world, reveals the historical accuracy of the South Africa citrus and grape crop estimates. Formica says that "the crop estimate error for citrus is going down but for grapes it shows no trend. An exception for citrus was in 2019/20 when error was above 7.5%. While grape estimate error appears to be increasing, there is so little data that it is not statistically significant."

For its part, the CGA states in its 2023 annual report that its goal is “for their estimates to be within 10% of final volumes passed for export.” Formica explains that they have remained well within that limit. On the other hand, for grapes, the error has been upwards of 10% in just the past few years. By publishing more data, SATI could make the overall trend in its grape estimate accuracy clearer.

Many factors which are hard to predict can cause the actual harvest to deviate from the estimate. Adverse weather, logistical problems, or changing regulations are a few. For example, the European Union introduced cold treatment requirements for South African citrus in the middle of the 2022/23 season, which cost exporters $12 million. Unexpected power cuts have also led to problems in the cold chain.

There may still be room for improvement. Formica believes that: "a combination of historical production data, high quality producer-level estimates, and long range weather forecasts used as input to machine learning models could reduce overall estimation error. It's unclear which models, if any, are applied." Of course, the cost of these methods must be weighed up against the benefit of increased accuracy.

In 2021 South Africa citrus and grapes exports were worth $US 1.9 billion and $0.9 billion, respectively. Investing some of this in better crop estimates could build trust with buyers, mainly in Europe. In comparison to SATI’s 10% error for grapes last season, Provid Peru’s error was only 1%, whereas ASOEX Chile’s was 18%. Increasing the transparency and accuracy of crop estimates has the potential to lift up the entire industry.

For more information:

Adam Formica

Sensonomic

Tel: +47 919 05 789

Email: [email protected]

www.sensonomic.com