The outbreak of the Red Sea crisis has taken its toll on many Egyptian export campaigns - citrus fruits being the first casualty - but it seems that the potato export campaign is holding up well. "At least that's the case for our company, as it is for others of the same size. There are certainly higher transport costs and logistical complications, but export volumes are not affected", says Yassen Abdelhay, export advisor to Arafa Company, an Egyptian potato exporter.

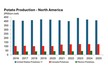

The potato sector owes its immunity to supply chain problems to the bigger crisis in global production of this essential crop for consumption. "Demand is simply too strong in Asian markets, and the main producing countries are experiencing serious problems, including in Asia. Potatoes have to reach their destination, even if they have to make the detour via the Cape of Good Hope. What also helps to mitigate the situation are the huge quantities exported. In Egypt, for example, we get the lowest transport prices on the market because of the quantities involved in potato exports."

The exporter describes a crisis behind the crisis: "The global fresh produce market is facing a number of challenges that could lead to a shortage of potatoes in 2024. Climate change and export bans imposed by major producing countries are among the issues causing concern. Experts warn that these challenges could lead to higher prices in the potato market. Several Asian countries, including Malaysia, Thailand, Indonesia, Oman, the United Arab Emirates, Kuwait, Sri Lanka, and Mauritius, rely heavily on other countries for their supplies of fresh potatoes. The main suppliers for these countries are Germany, India, China, Pakistan, Bangladesh and Egypt."

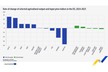

In turn, these countries of origin face numerous challenges that limit their supply, as Abdelhay lists:

- In Germany, climate change and the unavailability of seed potatoes for the 2024 season are causing instability in German production. The current situation in the Red Sea is also having an impact on shipping routes to Asian countries, forcing them to pass through the Cape of Good Hope, resulting in long transit times. To make matters worse, Germany has banned the use of anti-sprouting chemicals, meaning that extended transit times could lead to quality problems and damage, including sprouting. It is essential to keep these challenges in mind when considering the future of the German potato industry.

- Bangladesh recently authorized potato imports from India for the first time, in response to declining potato yields due to adverse weather conditions and climate change. According to local associations, this decline in potato yields has led to soaring prices in the country. This is a clear indication of the impact of climate change on agriculture.

- In India, the Ministry of Agriculture has forecast a 2% drop in the potato harvest for 2023-24 due to lower-than-expected yields caused by late blight diseases and erratic rainfall last November. As a result, local demand for processing potatoes has increased, raising concerns about a potential potato shortage in the country. The drop in potato production is also attributed to the fact that many farmers prefer to grow garlic rather than potatoes, due to last year's surge in garlic prices. If farmers don't manage to find a balance between the two crops, India may not avoid future shortages or an export ban as in onions.

- In Pakistan, potato crop yields are lower due to the scarcity of approved potato seeds. This scarcity not only reduces potato crop yields but also hampers growers' ability to meet quality standards, which in turn reduces potato quality.

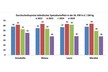

In this market configuration, which seems to persist over time - it has been the case for at least 2 or 3 seasons - international trade and the need for countries to diversify their food sources become all the more important. Abdelhay defends the Egyptian origin: "This is an opportunity for Egypt to increase its market share. We can play a strategic role in securing fresh potatoes to Gulf and Far East countries thanks to a number of advantages, including the availability of over a million tons of fresh Egyptian potatoes for export by September, of excellent quality with high solids and low sugar content, suitable for chips and French fries factories. Our main challenge is that the harvesting season will be over at the end of June, so all deliveries from July to September would have to be approved and stored during the harvesting season".

Abdelhay continues: "At Arafa Company, we are one of Egypt's key producers and exporters of potatoes and peanuts with a strong standing on the international market. We have extensive experience in exporting fresh Egyptian potatoes to Spain, Belgium, Croatia, Saudi Arabia, Kuwait, the United Arab Emirates, Indonesia, Lebanon, Iraq and other countries. We are the market leader in the export of processing potatoes (Lady Rosetta and Hermes varieties) meeting the ideal specifications for French fries (high solids, low sugar content). Our entire supply is produced on our own farms, which currently total 10,000 acres. We are an approved supplier to PepsiCo Egypt, Saudi Arabia, Indonesia, and Iraq, and also supply other factories around the world."

The exporter concludes: "We look forward to representing Egypt next month at the Macfrut exhibition, and importers from all over the world are invited to visit us at Hall B3, stand 151-D."

For more information:

Yassen Abdelhay

Arafa for export and agriculture development

Tel/WhatsApp: +201007244471

Email: [email protected]

www.linkedin.com/in/yassen-farouk-cma-mba-yassen-abdelhay-99415a82

www.arafatrade.com