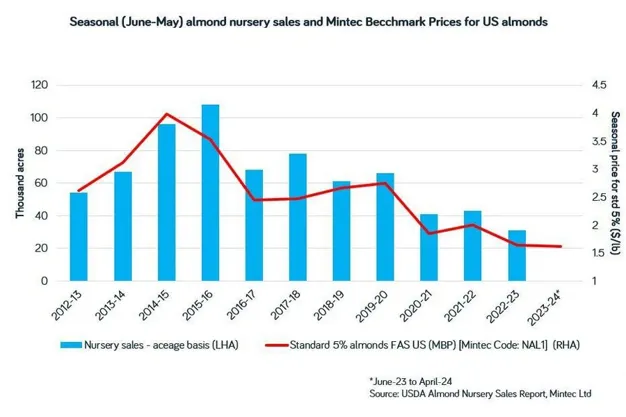

The latest almond nursery sales report, released by the USDA on 25th April, showed sales of new almond trees in 2022/23 (June-May) had slowed to 31 thousand acres. This figure is the lowest on records going back to 2012 and reflects the impact of low prices for the past several seasons on grower investment into the crops.

"People are struggling to pay for fertilizer and chemicals and are losing money on every acre farmed at the moment, so you'd have to be mad to be putting more trees in the ground the past few years," a US handler said to Mintec.

Prices have remained below the cost of production since the 2020/21 season, when the production rose to above 3 billion pounds for the first time. Since then, total supply has remained above 3 billion pounds, with market participants describing the crop as overplanted.

"There are too many almond trees in the ground and more need to be removed for supply and demand to go back into balance. Unfortunately, I think we will need to see bankruptcies at a grower level to speed up orchard removals before the industry returns to profitability," a US trader stated.

Cashflow constraints have also reportedly led to growers reducing inputs for the 2024 crop, with Mintec sources stating that growers have reduced applications of both fertilizers and protection products.

"We can't afford to stick to best practice this year, and we've had to focus our spending on our most productive orchards and reduce applications on everything else. It isn't just us. Lots of our neighbors are having to cut back to stay afloat for another year," a US grower disclosed.

February saw the private equity-backed Trinitas Farming, which was one of the largest almond growers in California, file for chapter 11 bankruptcy and market participants are expecting many family owned farms to go the same way, with one grower saying, "people have eaten through savings and extended lines of credit to breaking point. There isn't anywhere else to go; unless almond prices suddenly shoot back up, we are going to see a cascade of exits from the industry."

Currently, prices for new crop almonds are sitting at a 5-10 cent discount to current crop, and the industry is expecting another season of depressed pricing. The first set of industry estimates for the US 2024 US almond crop was released by trading house Terra Nova Trading on 15th April and pegged the crop at 2.97 billion pounds.

"For the industry to move forward, we need acreage to be reduced and production to fall. Until that happens, no one is going to be able to make any money, let alone invest in infrastructure and farming operations," a US handler stated.

Source: mintecglobal.com