A recent Rabobank report unveils a shift in the global avocado market, anticipating an increase in both production and trade. As the industry gears up for growth, Latin America holds its position as the top exporter, while the U.S. continues to be the primary importer. Despite a fragmented industry landscape in some regions, the market is moving toward consolidation, especially in South America, where competition and margin pressures are intensifying.

Regional production trends: A global overview

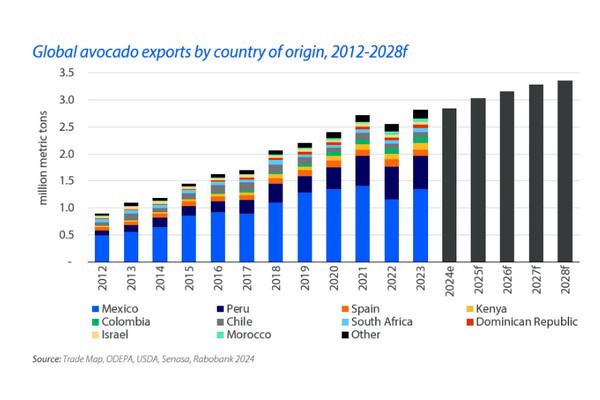

Global avocado exports are expected to surpass the 3 million metric ton milestone by 2025. Latin America remains at the forefront, yet the export scene is diversifying. Mexico, Peru, and Colombia will be the largest avocado exporters, according to the projections. Brazil, Ecuador, and other countries are emerging as exporters.

The fast growth of the European avocado market has spurred increased production in the EU, mainly in Spain. However, water availability remains a significant factor limiting large-scale expansion of avocado production and further area expansion is not expected for European production. Africa is witnessing steady growth, with Kenya maintaining its upward trajectory and Morocco's burgeoning exports as its trees mature.

Global avocado exports are expected to surpass the 3 million metric ton milestone by 2025.

Global avocado exports are expected to surpass the 3 million metric ton milestone by 2025.

To stay ahead, industry players are urged to innovate amid a competitive and challenging supply environment.

Destination market trends: Importers' appetite grows

The U.S.' appetite for avocados keeps growing, setting import records at 1.26 million metric tons in 2023, an 11% increase year-on-year. Mexico remains its primary supplier, with a staggering 90% share of imports. Europe's consumption patterns are evolving, with a projected increase in avocado purchases for 2024/25, assuming stable supply conditions. Europe's reliance on imports is set to grow, given its low self-sufficiency rate.

"Opportunities abound in Asia and Latin America, with untapped markets poised for growth. South American countries, in particular, are ripe for increased consumption, pending promotional and marketing initiatives," said David Magaña, Senior Analyst – Fresh Produce. Asia's imports have surged by 29 percent year-on-year in 2023, with China leading the way.

The future of the avocado industry: better avocados and larger companies

"While Hass avocados will continue to dominate, Hass-like varieties will gradually gain ground, particularly those with higher yield potential," said Magaña. "The industry faces price pressures as global production volumes rise, with quality and size being pivotal in the American and European markets."

South America's industry is consolidating, with large-scale companies increasingly dominating the landscape. This trend is expected to continue as the market responds to competition, margin pressures, and the demand for year-round supply.

Click here to read the report.

For more information:

For more information:

Melanie Bernds

Rabo AgriFinance

[email protected]

https://research.rabobank.com/