Presented by Agence Bio on Thursday, June 13 at a press conference in Reims, the 2023 figures show a year of stagnation. On the consumption side, the market remains stable. In the field, surface areas are down 2%, while the number of producers is up 2%. Foodservice is still lagging. According to the Agence, the positive points are the growth in direct sales, lower organic inflation, and the upturn in international organic sales.

"Decline in organic food's share in France's food baskets"

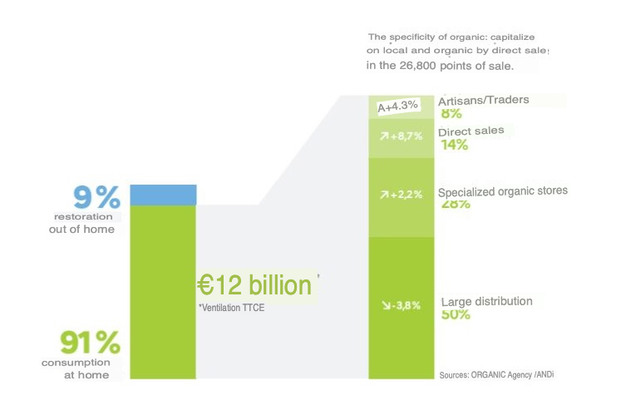

2023 French household food expenditure excluding inflation fell by 4.7% to 180 billion euros. The share of organic produce in French household spending will fall from 6% to 5.6%. The organic market is growing by 0%, with only 5 million euros in additional sales. Home consumption remains the dominant market, with 91% of organic farmers selling their produce to this market, against 9% for outside-the-home consumption, whether in canteens or restaurants.

"Direct sales are doing very well"

Except for supermarkets, all organic purchasing outlets are recording growth: craftsmen/shopkeepers 8% (+4.3%), specialist organic stores 28% (+2.2%), and, finally, direct sales 14% (+8.7%), according to Laure Verdeau, Director of Agence Bio, is "doing very well". "14% of purchases come from direct sales, with 27,000 organic farms using this method, i.e. 43% of farms, generating an additional €140 million. Direct sales remain the most dynamic channel for household consumption, with a 5% increase in sales outlets. Sales in specialized organic stores rose by €70 million, or 2.2%. The number of specialized organic stores is down by 7% to its 2017 level of 2,826 stores, the same number as 5 years ago, but with greater overall surface area.

General supermarkets saw a further decline in value of 3.8%, or €240 million, compared to 2022. This is the only channel to record a loss in value, primarily due to the reduction in the number of organic references offered in the 18,000 stores. Supermarkets now account for 50% of organic outlets.

"Fewer surfaces but higher numbers of producers"

With 2% of new organic producers, the balance is positive. This year, 7% of producers entered the organic sector, compared with the 5% who left. The agricultural landscape is changing, with smaller farms on the rise: these 2% more producers are accompanied by a 2% drop in organic acreage, representing 54,000 hectares less, mainly due to a decline in forage acreage (which accounts for 58% of organic acreage in France) and field crops (27%). "We've lost areas of forage and field crops to small-scale market gardeners", explains Laure Verdeau.

What is the situation abroad?

In Germany, the organic market will grow by 5% in value by 2023. Sales in supermarkets, which have maintained their organic offer, are up by 7%. All other channels are up by 2%, except for organic stores, where sales are stagnating. The market share of organic products will fall slightly in 2023, to 6.2% (from 6.3% in 2022). The cultivated area will increase by 5% compared to 2022, reaching 1.94 million ha, or 12% of the national UAA.

In Spain, the organic market will grow by 6% in 2023 compared to 2022, reaching €3 billion. In Italy, the organic market will increase by 8% to €5.5 billion. The market share of organic products in supermarkets was 3.2% in value (compared with 3.3% the previous year). Production figures for both countries will be released at a later date.

In the Netherlands, the organic market is expected to reach €1.8 billion in 2022. In 2023, organic sales in supermarkets will increase by 14% compared to 2022. The evolution of the overall organic market in 2023 is not yet known. In 2023, the Dutch organic area will increase by 8% to around 89,200 ha. The number of organic producers reached 2001, up 3% in 2022.

In Belgium, the organic market is up 21% in 2022 and will reach €1.153 billion in 2023. This increase is mainly due to inflation, but also to growth in organic sales in the Flanders region. The Flemish organic market will lead the way in 2023 with nearly €549 million, or 48% of the Belgian organic market, ahead of Wallonia with €457 million (+10% vs. 2022), or nearly 40% of the Belgian organic market, and Brussels with €146.9 million (13% of the Belgian organic market). In Belgium, salaries are adjusted for inflation. Belgium's organic market share is set to reach 4% in 2023, up slightly in 2022 (+0.3 points). Wallonia (where 90% of organic land will be located in 2022) will see a 1% drop in organic acreage compared to 2022. The number of producers in Wallonia is down by only 10.

In the UK, the organic market grew by 2% in 2023 compared to 2022, reaching €3.65 billion. The rise in the organic market is due to a 3% increase in supermarket sales by value, due to inflation. Supermarkets remain the leading distribution channel for organic products, with a 62% market share by value, ahead of home deliveries (16.6%) and independent distributors (15%). At the end of 2023, 497.9 thousand hectares of land in the UK were farmed organically (down 2% in 2022) by 3,416 producers. 60% of this area is located in England. The organic share of UAA is 3% for the UK as a whole.

In the United States, the organic market grew by 4% to €57.7 billion. It has more than doubled in ten years. In 2023, market growth is due to inflation, but also to an increase in volumes traded. In 2023, fruit and vegetables remain the main category of organic products purchased by Americans (32% of the national organic market and over 15% of the fruit and vegetable market), ahead of grocery products (24% of the organic market), beverages (15%) and dairy products (13% of the organic market and over 8% of dairy product sales).

For more information:

Agence Bio

agencebio.org