It has been three years since Frutura made its initial acquisition in the produce industry. During this short amount of time, the company has gone from a start-up with ambitious ideas around sustainability and being a year-round supplier of quality fruit to an all-round, global produce platform. The company's CEO, David Krause, reflects on Frutura's journey to date.

Five acquisitions have been made in three years and they were all characterized by refusing to build a bloated corporate organization with resultant overhead. "We want to operate as a nimble, lean start-up in perpetuity as it's impossible to pivot an organization that's top-heavy," said Krause. The ability to pivot turns out to be essential in 2024 as most of Frutura's resources go to the companies it has acquired. "We keep the focus on Frutura companies."

"I am very proud that a group of disparate companies in different geographies coalesced to deliver excellent numbers in 2023 and 2024. Both years are looking to be equally strong despite the impact of extreme weather and geopolitical issues in some cases." Krause shares some of the highlights of the different companies:

- Dayka & Hackett continues to be a powerhouse, adding critical avocado capability.

- Frutura Uruguay has reinvented itself into a strong enterprise, overseen by visionary leadership.

- Agricola Don Ricardo continues to lead through their longtime impact culture and is the first company within the Frutura Family to achieve B Corp certification.

- Subsole has survived several difficult table grape seasons and just finished a strong season, proving the importance of Chile as a global supplier.

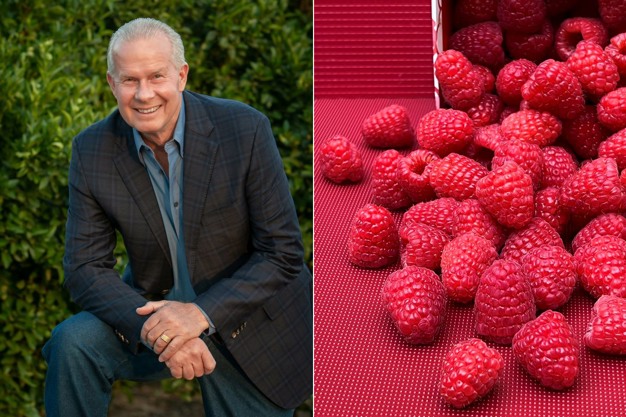

- Sun Belle's acquisition was huge as berries were the final 'chess piece' in Frutura's Big Six – grapes, citrus, mangoes, avocados, cherries, and now berries.

Frutura's companies all collaborate on their own, with little pressure from 'corporate'. "It shows the potency of the highly scalable Frutura platform and strategy," said Krause. "I've executed on plenty of integrations throughout my career and find this very encouraging." The company refused to compromise on having strong management teams in place at acquisition. "With the right people you can do almost anything, and our global leadership has been smart, collaborative, innovative, and ruthlessly determined to continually improve," he commented.

David Krause

David Krause

Challenges – external factors

However, not all the details could be planned out ahead of time. There were challenges to overcome with Acts of God and government actions having the biggest impact. Weather conditions across South America had a significant impact on the supply of many commodities. In addition, the uncertainty that comes with political upheaval in Chile and Peru, as well as the environmental pressures in Peru and the constant need to be mindful of managing precious water resources have been a challenge. Shifting tariff and trade implications, uncertain pricing pressures, and unprecedented cost increases have also had their impact on the business. Nevertheless, the company ended 2023 ahead of forecast and anticipates the same for 2024. "From the outset, I said we wouldn't settle on making sure to acquire companies with strong management and this shows what can be accomplished by having the right people and right strategy," shared Krause. "Great leaders make weathering the inevitable vagaries of fresh produce together -bearable- and sometimes even fun."

Prior to joining Frutura, Krause had been involved in several large acquisitions in North America. "However, I hadn't anticipated the acquisition dance that happens in Latin America today," he commented. In the past, when two companies came to an agreement, the execution of an acquisition was speedy. "I underestimated the time and costs involved with government entities and other third parties in bringing deals to a close, which led to a good deal of scrambling." Although Frutura doesn't plan on making acquisitions at the same rate in the years ahead, they are better equipped and more effectively resourced to do so with less disruption.

Looking forward

After three acquisition-heavy years, Krause is going to spend the balance of 2024 and perhaps the first half of 2025 growing each company and fully capitalizing on the power of the network. "It's time for optimization season, putting us in an excellent position for another growth milestone." Krause is confident growth could happen organically, through increased market penetration and perhaps new geographies as some potential customers are eager for Frutura to enter their markets. In addition, there are untold opportunities in Asia to maximize. "A year down the road, I believe the Frutura platform will be well-positioned for additional growth."

"As the company matures, at the heart of my focus will be not to take our eyes off being a customer-centric company. Because we were founded so recently, we've had the luxury of forming a thoroughly modern company, designed to mitigate the challenges our customers face today."

More acquisitions?

Frutura's goal was to have the right mix of crops to be able to live up to its core promise of getting as close as possible to offering the customer their preferred fruit 365 days per year. "I'm satisfied with our depth and capability in our critical six crops," said Krause. "To be in an enviable revenue situation after three years of being in an ag climate that was 'challenging' at best speaks to the power of the Frutura platform as well as our belief that putting the customer first is always good business."

Nevertheless, if there is an opportunity to expand the company's geographies in a smart way or add capacity, the company would be open to making a great deal. It is however very committed to the structure of the Frutura platform and the need for alignment is critical. "Not everything fits, and it takes discipline not to get so vested in an acquisition that you don't have the courage to pass when your gut says 'no'. Not every idea is a good one and knowing when you're wrong, and admitting it, is critical."

Frutura 5 years down the road

"I wouldn't have believed it if you told me five years ago that berries were going to be one of my top priorities," commented Krause. Therefore, it is difficult to predict where the market will be in 2029, but it will likely involve newly important crops and varieties, as well as increasing global reach, and a continued emphasis on quality, freshness, and flavor.

Most importantly, the consumer increasingly wants quality without sacrificing sustainability, from production to packaging. "I believe there will be a sea change in educated consumers wanting to know the sustainability story of the fruit they consume." Frutura feels well-positioned to be in the right place at the right time around impact. "It has been part of our foundational ethos and will be an even more significant market-driver in the years ahead."

For more information:

For more information:

Alison Holt

Frutura

[email protected]

www.fruturaproduce.com