This is the last year a 10-person barbecue for the 4th of July will cost less than $100. That was just one key conclusion taken from the annual Rabobank BBQ Index presented this week in which more than 80 North American analysts contributed to insights on food pricing–from dairy to beverages to protein and of course, produce.

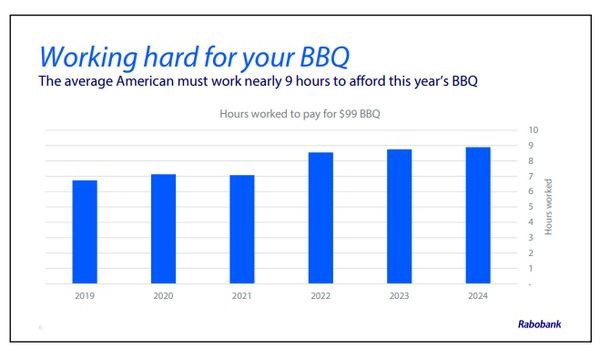

Tom Bailey, senior consumer foods analyst with Rabobank, began the presentation with an economic outlook for today's consumers, starting with the fact that while real wages are slowly improving for the average U.S. consumer, they still have to do more than a full day's work to afford this year's BBQ. "Real national average wages are about $11.15.hour. With this year's total barbecue cost of about $99, the average American will have to work about nine hours to afford this year's barbecue for 10 people. That's a 32 percent increase from 2019 in how hard you're having to work," says Bailey, adding that while wages are up 25 percent since 2019, food pricing is up 30 percent.

With inflation at levels that haven't been seen since the 1970s, consumers are also working hard to find value in this market and are eating more at home but also spending less, and they're deal hunting. "Many consumers are becoming much more value-focused and eating more at home. Incremental inflation is causing inflation fatigue as the final straw driving some behavioral shifts," says Bailey.

Foodservice vs. retail

He notes that it's nearly $100 for a family of five to eat a simple meal out: in Q1 of 2024, foodservice transactions were down 8 percent; fast-casual restaurants down 5 percent and quick service restaurants (QSR) down 4 percent. "Where are they going? Discounted grocers such as ALDI saw a 14 percent increase in transactions in Q1 and warehouse club stores up 7 percent," he says. "We can see the value transfer happening here and we expect this trend to intensify in the second half of the year."

This comes after years of restaurants a taking share of wallet from grocery stores with food service accounts for about 56 percent of total consumer spending on food currently versus 44 percent for grocery. "We're likely to start seeing a shift in transactions though," says Bailey. "Foodservice and grocery are fighting to keep consumers coming into their stores. McDonald's, Burger King, Wendy's, Starbucks, and more have launched deals to woo consumers back and retailers are also offering deals," he says, noting some are offering $5 meal deals to compete with QSR meals. Notably, Target recently announced it would reduce prices on over 5,000 products, including food.

However, consumers will also occasionally pay up for experiences. "They want memories, not leftovers. They want good things and they're willing to pay up for affordable luxuries," he says.

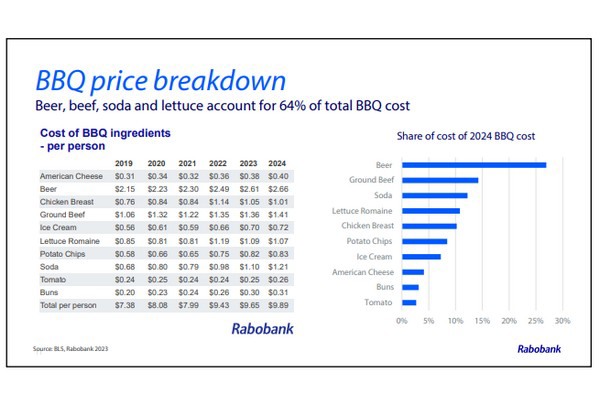

With that barbecue ringing in at $99, that's up 2 percent from last year's barbecue. "At face value, 2 percent seems modest. However it comes after a 29 percent increase in overall costs for a barbecue since 2019," he says, noting the barbecue is ringing in at $9.90/person though beverages take up to 40 percent of that cost.  Looking closer at produce

Looking closer at produce

David Magaña, Rabobank's senior analyst – fresh produce, looked at four key produce items featured in the barbecue: potatoes, lettuce, tomatoes and avocados.

Potatoes: "U.S. potato production has been declining for several years impacted by drought and more so we saw very elevated prices in 2022," says Magaña. In turn, this incentivized more plantings in 2023, and combined with better water availability in key production regions, production bounced back in the U.S. and in 2023, was the highest since 2018.

In turn, fresh market prices are less than half of what they were last year: Russet potatoes are about $12-$14/carton, and a year ago they were more than $25/carton.

While fresh market potatoes are more affordable than say processed potatoes in the form of chips, the potato market has become more complex given all the new specialty potatoes that are coming to the market.

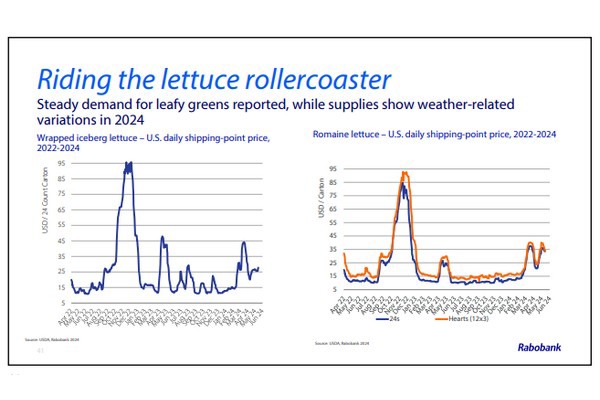

Lettuce: A volatile market given its susceptibility to weather shocks that impact prices, lettuce pricing by the end of 2022 was unusually high given a combination of supply-side factors. "More recently we've seen volatility given the transition of the season during the spring. Growing conditions in key areas such as the Central Coast in California were still cold and now we are likely to see some heat waves, even in Salinas," says Magaña.

While in the past few weeks lettuce production was below what was expected and pricing was stronger, as summer arrives with better weather conditions, lettuce quality and availability have improved. "Prices should be similar to those last year in July," he says.  Tomatoes: Volatility in these markets has also led to stronger pricing compared to historical averages. "There's been drought in Mexico for the past 18 months and of all of the fresh tomato consumption in the U.S., about 60 percent of all that is imported–about 90 percent are from Mexico," says Magaña.

Tomatoes: Volatility in these markets has also led to stronger pricing compared to historical averages. "There's been drought in Mexico for the past 18 months and of all of the fresh tomato consumption in the U.S., about 60 percent of all that is imported–about 90 percent are from Mexico," says Magaña.

That drought has led to a decline in acreage in Mexico. "Prices have been higher than average. However, in summer, the U.S. relies less on imports, and those strong prices have incentivized plantings in the U.S. Tomato prices are likely to approach the historical average for this time of the year," he says.

Avocados: "If you want to add avocado to your burger, that may cost you a little bit more," says Magaña. "Prices in 2024 are about 40 to 50 percent higher than a year ago."

However, a year ago prices were unusually low during the first half of 2023 given plenty of availability. Also, the recent pause on avocado inspections in Michoacan has led to strengthened pricing–reports indicate cartons have gone from $50/carton a few weeks ago to about $70/carton.

Though this suspension, which has since been lifted, is different compared to the import ban in February 2022. Then, Michoacan was the only state in Mexico certified to export avocados to the U.S., and later in 2022, Jalisco received approval to export to the U.S.

That 2022 ban also happened in February, a time of year when the U.S. market relies almost 100 percent on imports. "Now, June-July is the lowest share of Mexican avocados in the U.S. market," says Magaña. "California is at peak production and Peruvian shippings are also at their peak. California also just updated their production estimate and the mid-season harvest estimate is 20 percent higher than the preseason estimate. That will help with the prices and the price increases aren't going to last as long as the one we saw in 2022."

Additionally, avocado consumption continues to rise. In the U.S. in 2000, consumption was 2 lbs/person/year. By 2010, it was 4 lbs/person/year, and by 2022, it doubled again to 8 lbs/person/year and now is close to 10 lbs/person/year.

For more information:

For more information:

Melanie Bernds

Rabo AgriFinance

[email protected]

https://research.rabobank.com/