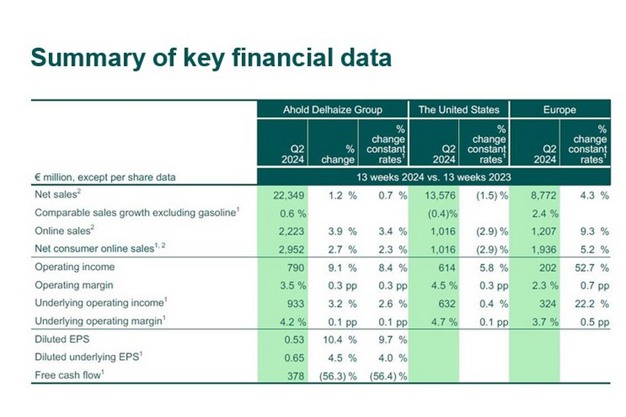

Ahold Delhaize, one of the world's largest food retail groups and a leader in both supermarkets and e-commerce, reported their second quarter results today. Q2 Group net sales were €22.3 billion, up 0.7% at constant exchange rates and up 1.2% at actual exchange rates. Q2 comparable sales excluding gasoline increased by 0.6% for the Group, with a decrease of 0.4% in the U.S. and an increase of 2.4% in Europe.

Online sales increased by 3.4% in Q2 at constant exchange rates and by 3.9% at actual exchange rates. Online sales were negatively impacted by 8.0 percentage points due to the divestment of FreshDirect. This was offset by double-digit growth at Food Lion, Hannaford, The GIANT Company and Albert Heijn.

Q2 underlying operating margin was 4.2%, an increase of 0.1 percentage points due to strong performance in both the U.S. and Europe. Q2 IFRS operating income was €790 million and IFRS diluted EPS was €0.53. IFRS results were €143 million lower than underlying results, largely due to costs related to the Belgium Future Plan.

Q2 diluted underlying EPS was €0.65, an increase of 4.5% compared to the prior year at actual rates. 2024 interim dividend is €0.50 (2023: €0.49), based on the Group's interim dividend policy. The Company reiterates its 2024 full-year outlook, including underlying operating margin of ≥4.0%; underlying EPS at around 2023 levels; free cash flow of around €2.3 billion; and net capital expenditures of around €2.2 billion.

Comments from Frans Muller, President and CEO of Ahold Delhaize: "I am pleased to report a second quarter performance that places us well on track to achieve our strategic aspirations and financial goals for 2024. At the same time, we saw strong and improving momentum at our brands in both regions. Group net sales grew 0.7% at constant rates, while comparable sales excluding gasoline increased by 0.6%. Excluding calendar shifts, the latter would have been 1.0 percentage points higher."

"As growth rates in the industry normalize, our omnichannel ecosystems are proving a major competitive advantage and source of market share gains. In Q2, online sales were again fueled by double-digit growth in online grocery in both Europe and the U.S., excluding the divestment of FreshDirect. Here we are seeing both new customer growth and strong customer retention. At the same time, we are making strides in e-commerce profitability. In the U.S., the shift in demand to more profitable channels and our initiatives to optimize the store-first fulfillment model are paying off. In the Netherlands, Albert Heijn has opened its second fully automated Home Shop Center (HSC) in Zwolle. With positive momentum going into the second half of the year, I am confident that we are more than well on track to achieve our commitments for 2024."

For more information:

For more information:

Ahold Delhaize

Tel: +31 88 659 9211

Email: [email protected]