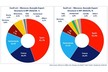

The supply of avocados in the U.S. is stable with fruit coming from primarily Mexico followed by Peru and California.

In July, Peru exported around 80,110 tonnes of fruit globally. Compare that to July 2023 which saw 126,530 tons exported. "The difference in volume is because this year, much more early fruit was exported. In February, the demand in Europe was very high with good prices so a lot of early fruit was exported which saturated the European market earlier than expected," says Gino Neira, co-founder of Inkawald, a family-owned company based in Peru, adding that February this year saw 60 percent more fruit exported compared to February 2023.

In July, Peru exported around 80,110 tonnes of fruit globally.

In July, Peru exported around 80,110 tonnes of fruit globally.

Peruvian avocados come from a few different regions. In the highlands, fruit is harvested from Apurimac, Ayacucho, Cusco, and Huancavelica. In the south, there's fruit in the regions of Ica, Arequipa, Moquegua, Tacna and in the north in the regions of Ancash, La Libertad, Lambayeque, and Piura. "Right now we have fruit in the Ancash region. We are currently exporting a weekly container with fruit from this region," says Neira, noting that while it's been exporting organic avocado for five years, it's also recently added a line of conventional avocados. It is also looking for a strategic partner to form a commercial alliance with to ship to the U.S.

Wider Peruvian window

Overall, in recent years, the Peruvian commercial window has been extended, starting in February with fruit from the valleys of the Peruvian highland region and going until the end of October with fruit from the coast. "Peru is the eighth country with the largest freshwater reserves in the world. The Peruvian coast has benefited from large irrigation projects that have allowed the expansion of agricultural areas by providing water for irrigation in arid regions," says Neira. "The construction of reservoirs and dams have also improved the storage and regulation capacity of water."

In recent years, the Peruvian commercial window for avocados has been extended.

However, with more early fruit being exported this year, the Peruvian fruit campaign is expected to end earlier than other years, possibly in September.

Demand to strengthen

As for the demand for avocados, it is stable. "Demand will start to increase as the weeks go by, which could lead to a global shortage with rising prices," says Neira.

Of course, global demand continues to grow for the popular fruit. In the U.S. market, the demand for avocados per capita is three times higher than in Europe, especially because of the large population of Latin American consumers who live in the U.S.

Neira says the Peruvian coast has benefited from large irrigation projects that have allowed the expansion of agricultural areas by providing water for irrigation in arid regions.

Neira says the Peruvian coast has benefited from large irrigation projects that have allowed the expansion of agricultural areas by providing water for irrigation in arid regions.

So where is all of this leaving avocado pricing? "The average prices in the U.S., depending on the size and origin, range from $3.40/kg to $5.00/kg," says Neira, noting the pricing variation is -10 percent from last week, though up 25 percent compared to the same week last year. "Prices are expected to increase in the United States market, especially for Mexican fruit, given the low volumes. In the coming weeks, it will be interesting to see if there will be a shortage of fruit in the market, which would result in a price increase and greater dynamism."

For more information:

For more information:

Gino Neira

Inkawald

Tel.: +511 760 9944

[email protected]

https://www.inkawald.org/