Calavo Growers, Inc. has disclosed its financial outcomes for the fiscal third quarter, concluding on July 31, 2024.

Net sales increased 11.7% to $179.6 million in the latest quarter

- Total net sales increased 11.7% to $179.6 million from the prior year quarter

* Grown segment net sales increased 13.3% to $163.2 million

* Prepared segment net sales decreased 2.4% to $16.4 million - Total gross profit decreased 8.7% to $20.1 million from the prior year quarter

* Grown segment gross profit decreased $1.2 million to $18.2 million

* Prepared segment gross profit decreased $0.8 million to $1.9 million - Net income of $5.4 million, or $0.30 per diluted share, compared to net income of $8.7 million, or $0.48 per diluted share for the prior year quarter

- Adjusted net income of $10.2 million, or $0.57 per diluted share, compared to adjusted net income of $7.7 million, or $0.43 per diluted share for the prior year quarter

- Adjusted EBITDA of $13.5 million compared to $13.0 million for the prior year quarter

Calavo Growers maintains growth amid challenges, plans for new guacamole products

Lee Cole, President and Chief Executive Officer of Calavo Growers, Inc., reported that the company's third-quarter performance demonstrated sustained progress in its primary avocado sector. He noted that despite facing temporary supply challenges from Mexico, the company achieved strong financial outcomes, attributing this success to operational adaptability and the resilience of their team. Cole mentioned that the guacamole segment faced challenges due to increased costs of fruit inputs compared to the same quarter in the previous year, yet saw a 7% increase in volume owing to strategic efforts to expand this part of the business. Additionally, he announced plans for the introduction of new guacamole products in the upcoming fourth quarter.

"Our momentum has carried into the fourth quarter, and we look forward to delivering solid financial results for the fourth quarter and fiscal year. We intend to deploy the cash that we generated from the sale of our Fresh Cut business by investing in our core avocado and guacamole businesses and by returning cash to shareholders over time. Given the renewed focus on our core operations, improvements in our financial performance, and our confidence in our operational execution going forward, I am pleased to share that we have doubled the quarterly dividend to $0.20 per share."

Calavo Growers reports increased sales and adjusted EBITDA amidst strategic adjustments

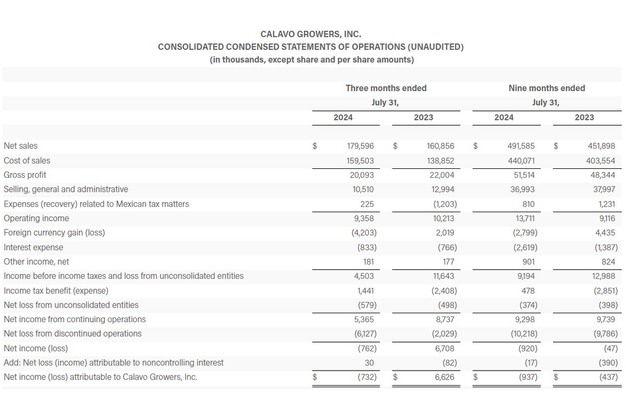

Total net sales for the third quarter were $179.6 million, compared to $160.9 million for the same period last year, an increase of 11.7%. Grown segment sales increased 13.3%, and Prepared segment sales decreased 2.4%. The average selling price of avocados in the Grown segment increased by 25% compared to the prior year.

Gross profit for the third quarter was $20.1 million, or 11.2% of net sales, compared to $22.0 million and 13.7%, respectively, for the same period last year.

Selling, general and administrative (SG&A) expenses for the third quarter totaled $10.5 million, or 5.9% of net sales, compared to $13.0 million and 8.1% of net sales for the same period last year.

Net income for the third quarter was $5.4 million, or $0.30 per diluted share. This compares with net income of $8.7 million, or $0.48 per diluted share, for the same period last year. The change in net income compared to the prior year is primarily driven by the change in foreign currency remeasurement from gain to loss and the income tax benefit.

Adjusted net income was $10.2 million, or $0.57 per diluted share, compared to adjusted net income of $7.7 million, or $0.43 per diluted share last year. Adjusted EBITDA was $13.5 million compared to $13.0 million for the same period last year.

On August 15, 2024, the company closed the sale of its Fresh Cut business for $83.0 million, subject to various closing adjustments.

Balance Sheet and Liquidity

The Company ended the quarter with $39.0 million of net debt, which included $33.5 million of borrowings under its credit facility and $6.6 million of other long-term obligations and finance leases, less cash and cash equivalents of $1.1 million. The Company reduced its net debt by $9.5 million and had approximately $57.3 million of liquidity as of July 31, 2024. Subsequent to quarter end, we retired the remaining debt balance with proceeds from the sale of the Fresh Cut business.

Calavo's grown and prepared segments' performance amid challenges

Grown

Grown segment gross profit was $18.2 million, a decrease of $1.2 million from the prior year quarter. Avocado prices increased by 25% compared to the third quarter last year while avocado margins improved, which helped to offset an avocado volume decline of 4.5%. The volume decline was partly attributed to the impact of supply disruptions from Mexico during the quarter, which have since been resolved. The team effectively utilized operational adaptability to minimize the disruptions' impact on customers and investors. Gross profit attributed to tomatoes declined versus the prior year on lower volume.

Prepared

Prepared segment gross profit was $1.9 million, a decrease of $0.8 million from the third quarter last year. Gross margin declined to 12% from 16%, primarily driven by higher fruit input costs compared to the third quarter last year. Calavo Growers efforts earlier in the year to build inventory using lower cost fruit helped to mitigate the impact of higher fruit costs during the quarter. The company expects margins in the guacamole business to improve in the fourth quarter as input costs recede. In addition, Calavo Growers plans to launch some innovative new guacamole products during the fiscal fourth quarter that is expected to support growth in fiscal 2025. Overall, Calavo Growers expects sequential improvement in the Prepared business in the fiscal fourth quarter as compared to the third quarter.

Click here for the full report.

For more information:

Calavo Growers, Inc.

1141A Cummings Road

Santa Paula, CA 93060

hello@calavo.com

www.calavo.com