Mission Produce has released its financial results for the fiscal third quarter ending July 31, 2024.

Revenue up with 24%, net income rises to $12.4M

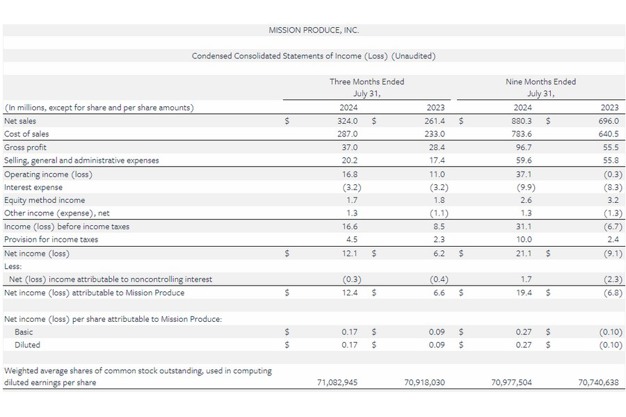

- Total revenue increased 24% to $324.0 million compared to the same period last year.

- Adjusted EBITDA increased 49% to $31.5 million, compared to $21.2 million in the same period last year.

- Cash flow from operations for the nine months ended July 31, 2024 was $55.4 million, compared to cash used of $(7.3) million in the prior year period.

CEO Message

"This quarter's financial results show a solid performance, with third quarter revenues reaching $324.0 million, a 24% increase year-over-year, and adjusted EBITDA rising by 49% to $31.5 million," reported Steve Barnard, CEO of Mission. The company plans to maintain its focus on operational efficiency, strategic growth, and effective capital allocation to support long-term value.

Revenue and profits rise amid market challenges

In the third quarter of fiscal 2024, total revenue saw an increase of $62.6 million, or 24%, compared to the same period the previous year. This growth was largely attributed to the Marketing and Distribution segment, which experienced a 36% rise in the average per-unit sales price of avocados. This increase helped to counterbalance a 10% drop in the volume of avocados sold. The changes in price and volume were influenced by a reduced avocado supply, caused by weather-related impacts on fruit development and production in Peru, as well as disruptions in fruit harvesting in Mexico. Despite a decrease in overall volume, domestic sales volumes remained relatively unchanged during the quarter, indicating stable demand for avocados in the U.S. market despite higher prices.

In the third quarter of fiscal 2024, gross profit rose by $8.6 million compared to the same period in the previous year, reaching $37.0 million, with the gross profit margin increasing by 50 basis points to 11.4% of revenue. These gains were primarily driven by the Marketing and Distribution segment, where the strong per-unit profit margins from avocado sales compensated for the decrease in volumes sold. Conversely, the International Farming segment saw a decrease in gross profit due to a $3.2 million asset write-down related to undeveloped land reclaimed by the Peruvian government. When disregarding the asset write-down, the International Farming segment's gross profit slightly declined during the quarter. This was due to the negative effects of lower harvest yields on the absorption of fixed costs, which were nearly balanced out by higher sales prices and cost-saving strategies.

Net income for the third quarter of fiscal 2024 was $12.4 million, or $0.17 per diluted share, compared to $6.6 million, or $0.09 per diluted share, for the same period last year.

Adjusted net income for the third quarter of fiscal 2024 was $16.7 million, or $0.23 per diluted share, compared to $10.3 million, or $0.15 per diluted share, for the same period last year.

For the third quarter of fiscal 2024, adjusted EBITDA reached $31.5 million, marking a $10.3 million or 49% increase from $21.2 million in the same period of the previous year. This growth was mainly due to an improved gross profit in the Marketing & Distribution segment.

Blueberries

Net sales in the Blueberries segment were $1.6 million for the third quarter of fiscal 2024 compared to $1.4 million for the same period last year. Segment adjusted EBITDA was $0.1 million for the third quarter of fiscal 2024 compared to $0.2 million for the same period last year.

Balance Sheet and Cash Flow

Cash and cash equivalents were $49.5 million as of July 31, 2024, compared to $42.9 million as of October 31, 2023.

The Company's operating cash flows are seasonal in nature and can be temporarily influenced by working capital shifts resulting from varying payment terms to growers in different source regions. In addition, the company is building its growing crops inventory in its International Farming segment during the first half of the year for ultimate harvest and sale that will occur during the second half of the fiscal year. In the third quarter, the company experienced advantageous circumstances which pulled forward the working capital benefits that it would otherwise expect to realize in the fiscal fourth quarter.

Net cash provided by operating activities was $55.4 million for the nine months ended July 31, 2024, compared to cash used in operating activities of $7.3 million in the prior year period, driven by improved operating performance and working capital management. Improvement in working capital was largely driven by favorable changes in grower payables during the third quarter of 2024 resulting from an advantageous mix of source market fruit versus the prior year.

Capital expenditures are expected to remain in the range of $40 to $45 million for the full year fiscal 2024.

Click here to read the full report.

For more information:

Jenna Aguilera

Mission Produce

Email: [email protected]

www.missionproduce.com