Fortunately, the long-feared strike in the US East Coast ports, ended after just three days of strike, and the members of the International Longshoremen's Association (ILA) went back to work in the ports on October 4th. This may not be the end of it, as the strike concluded with a tentative agreement, and a deadline set for reaching a final agreement by January 15th.

As the strike was quite short-lived, the impact was much less than the worst fears, but nonetheless, the 3-day strike did cause vessels to queue, which will have a negative impact on the availability of capacity in origin regions. In the most optimistic view, the impact is limited to the three days of striking, but realistically, as it will take some time to clear the backlog of vessels and containers, the impact is likely to be closer to a week of capacity loss.

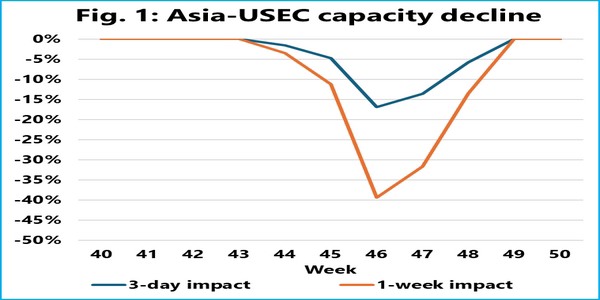

Figure 1 shows the relative capacity loss for Asian exporters, where a 3-day and a 1-week impact, are compared against a baseline scenario where there is no strike. Here we see a -17% drop in capacity offered from Asia to US East Coast in week 46, if the impact is limited to the minimum of vessels being stuck in US East Coast for just 3 days, while if it takes a full week to get the vessel backlog cleared, then we approach a -40% capacity loss for a short period. Similarly, for North Europe to US East Coast, exporters should prepare for a capacity reduction of -14% in week 44, rising to -30% if the clearing the congestion takes a full week. On Mediterranean to US East Coast, a 3-day impact leads to a -10% capacity loss in week 43, increasing to -25% for a week-long impact.

Will the shipping lines take action to mitigate this capacity shortfall? We find this to be quite unlikely. To do so, would require speeding up the vessels quite substantially – especially on the shorter Transatlantic trades – and this would be in a market environment, where the ending of the strike, would likely mean a continuation of the rate declines we have seen recently. Exporters, especially in Asia, North Europe, and the Mediterranean, should therefore prepare for a temporary, short-term crunch in capacity.

For more information:

Sea-Intelligence

Centennial Tower #17-13

3 Temasek Avenue

Singapore 039190

Email: [email protected]

Website: www.sea-intelligence.com