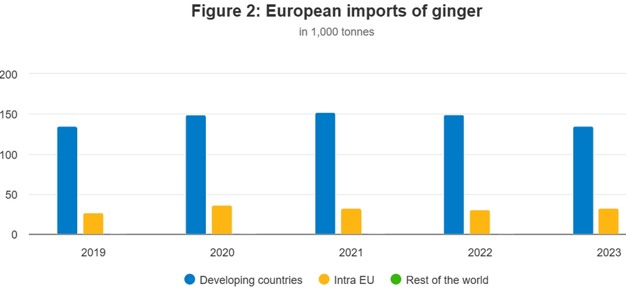

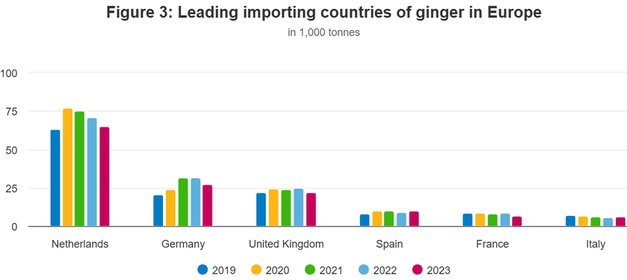

The European market for ginger offers opportunities for suppliers from developing countries. In the coming years, the demand is expected to grow. A healthy lifestyle, a growing demand for Asian cuisine and the widespread use of ginger in the food and beverage industry is driving this growth. The leading importing country for ginger is the Netherlands, followed by Germany and the United Kingdom.

Product description

Ginger is the unevenly shaped underground plant stem of the plant Zingiber officinale (botanical name of the ginger plant). The plant is cultivated in tropical climates in different parts of the world. Large-producing countries include India, Nigeria, China, Nepal and Indonesia. The top 3 exporting countries to the European Union are China, Peru and Brazil.

Fresh ginger is processed in Europe into:

Puree for the food processing industry, refrigerated or frozen.

Ginger juice (as an ingredient for blends, a main ingredient for ginger shot drinks or bottled in jars for home and the food service market).

Frozen, cut, and packed ginger pieces.

This study only focuses on exporting fresh ginger to the European market. The study for dried ginger is categorized under the spices and herbs section. However, both markets are related to each other. Overall, more fresh ginger is exported than dried ginger. Also, most fresh ginger is hydrated to a 70% moisture content level before shipping.

Germany: biggest consumer of ginger

Germany is the largest consumer market for ginger in Europe and also the largest market for organic-certified fresh fruits and vegetables, including ginger. The annual consumption peaked at about 30,000 tonnes in 2021 and 2022. Demand is the highest in the winter months. As ginger is thought to help fight the flu, it is especially high in demand during the flu season.

Germany is the second largest importer of ginger in Europe. In the period from 2019 to 2021, ginger imports increased. However, Germany's imports of ginger dropped from 32,000 tonnes in 2022 to 27,000 tonnes in 2023 (-14%). Overall, the average annual growth has been quite positive (+7.1%). In 2023, the consumption of health-related and relatively expensive ingredients like fresh organic ginger was under pressure due to the high inflation that year.

97% of Germany's ginger is imported directly from developing countries. Just like in the Netherlands, the countries China, Peru and Brazil are the leading suppliers of ginger. They hold a share of 59%, 27% and 6.6%, respectively. Imports from these countries have increased significantly over the past five years, ranging between 7.4% of average annual growth (China) to 35% (Brazil). Germany imports less and less ginger through the Netherlands. In 2019, the Netherlands still had a share of 14%, but this decreased to 3% in 2023. In other words: Germany is now relying more heavily on imports from developing countries.

To read the full CBI report, please click here.

For more information:

CBI

www.cbi.eu